Create Cards

Get 24/7 access to virtual and physical card creation. Set custom limits and auto-expiration dates so your employees' expenses and supplier payments are always in your control.

.png)

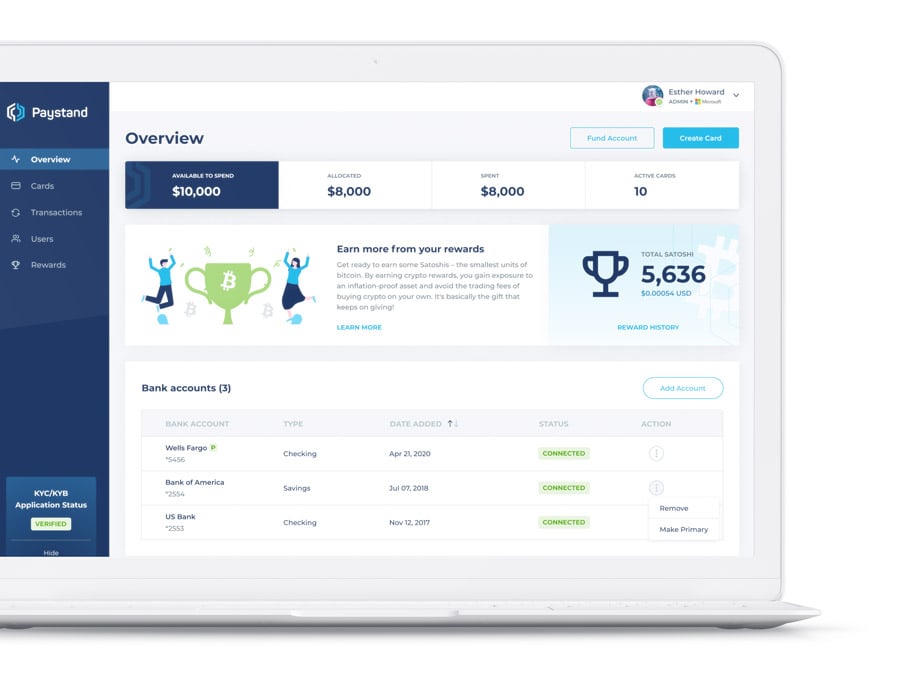

Control and manage business expenses with flexibility and ease

/Product%20Images/Mock_Up_Landing%20(1).png?width=800&height=423&name=Mock_Up_Landing%20(1).png)

|

|

|

||

Business cards for your whole team

|

|

Take control over your spend

|

|

Monitor spend with greater visibility

|

Get 24/7 access to virtual and physical card creation. Set custom limits and auto-expiration dates so your employees' expenses and supplier payments are always in your control.

Prevent unauthorized charges and track transactions with their receipts, memos, and accounting categories all in one place. Say goodbye to employee reimbursements.

Track all card transactions automatically in a single platform by class and category. Employees can upload receipts with each transaction right from their dashboard.

Sign Up TodayWith Paystand Spend, you can create virtual and physical cards any time, anywhere. You can assign cards internally for your company, or externally for your supplier payments.

Sign Up Today

Apply for a Paystand Spend account within minutes that gives you tighter control over your team’s expenses and bitcoin rewards.

Sign up and an account executive will be in touch!

Questions or need support? Submit a ticket https://support.paystand.com/hc/en-us

or give us a call 1-800-708-6413

Paystand Spend is available to corporations and other forms of non-individual liability companies. Paystand underwrites with Employer Identification Numbers (EINs), so consumers, sole proprietors, and other unregistered businesses are ineligible. Only companies organized and registered in the United States (such as C-corps, S-corps, LLCs, or LLPs) may apply for a Paystand Spend Card account.

Consumers, sole proprietors, unincorporated partnerships, and companies registered outside the United States are not permitted to use, or attempt to open or use, a Spend Card account. There are also some prohibited activities and businesses that Paystand cannot support, see our Terms of Service.

Your Paystand Spend Account comes with pre-funded limit by Paystand when you are approved, and you pay back this limit on a daily basis from the bank account you link when you apply.

You can either pre-pay your Paystand account via wire or get access to a pre-funded spend limit that Paystand advances. If you opt in for a pre-funded spend limit, Paystand initiates a daily ACH pull on your business’s bank account to recuperate what you spent with the cards within a 24 hour time frame. The payment typically settles within 4-6 business days, at which point your account’s available balance will be restored.

You will link your business bank account when you apply.

No. Applying for Paystand Spend, whether your application is approved or rejected, will never affect your personal or business credit score.

Paystand determines your business account spend limit based on your spend needs and bank account balance. We may increase your spend limit as you consistently pay your cards.

If you suspect any unauthorized charges, you can dispute charges here. Our team will investigate and attempt to resolve within 10 business days of notice, with the option to extend this period to up to 45 days from receipt of notice with provisional credit.

View our terms and conditions.