ACCOUNTS RECEIVABLES

- Receivables

-

Payables

ACCOUNTS payables

WHY NOW

Our push into Accounts Payables comes with our mission of becoming the one stop shop for the CFO.

By integrating AP, our financial suite becomes even more powerful as we aim to automate everything money.

-

Payments

OUR NETWORK

Discover how we enable your business to receive fee-less payments at a faster speed than your current solution.

We transition your costliest payers into cost-effective payment rails to return the most positive of ROIs.

- Expense

-

Resources

DATA & INFRASTRUCTURE

LEARNING RESOURCES

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Payments as a ServicePARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

ABOUT US

See how we are rebooting commercial finance.

Where We Operate

United states

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.canada

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

Optimized Payment Processing for Acumatica with Paystand

Paystand seamlessly integrates with Acumatica to revolutionize B2B payment processing. Automate invoicing, reduce processing fees, and speed up cash flow with a zero-fee, seamless payment experience designed for modern finance teams. With a fully integrated payment solution, businesses can eliminate inefficiencies, enhance transaction security, and gain complete visibility into their financial operations, all within Acumatica.

"Since working with Paystand, we’ve saved almost 20 hours of work a week."

See how Motorola reduced costs by 16%.

SOFIA MITCHELL

Accounting Analyst

"Real-time updates and analytics have made it easier to forecast and budget cash flow."

CHAD BELLO

Revenue Accounting Manager

“We found Paystand so easy to use; their embedded payment links in our invoices are simple for customers. Our clients and vendors are no longer confused at the critical moment when they’re ready to pay.”

JAMES ALLEN

CEO

"Paystand allows us to free up resources, reduce costs, and expedite payments with real-time posting of transactions. It gives us the ability to grow with confidence that our AR process is equipped to handle the pace of our business."

KRISTEN PARISIEN

Controller, Global Prescription Management

BEN COLE

President

“It’s almost creepy how easy Paystand makes my job. It’s unbelievable how automated it is. It’s been an even better experience than we anticipated. . . We just fully trust Paystand.”

JOHN DYBWAD

Vice President of Finance & Budget

Reduce Costs

Say goodbye to excessive processing fees with our zero-fee payment network. Unlike traditional credit card processing solutions that charge high transaction fees, Paystand enables businesses to retain more revenue with cost-effective, direct-to-bank payments.

Enhance Security

Leverage blockchain technology for transparent, secure transactions. Every transaction is verified, encrypted, and recorded immutably, providing businesses with enhanced fraud prevention and financial security.

Automate Workflows

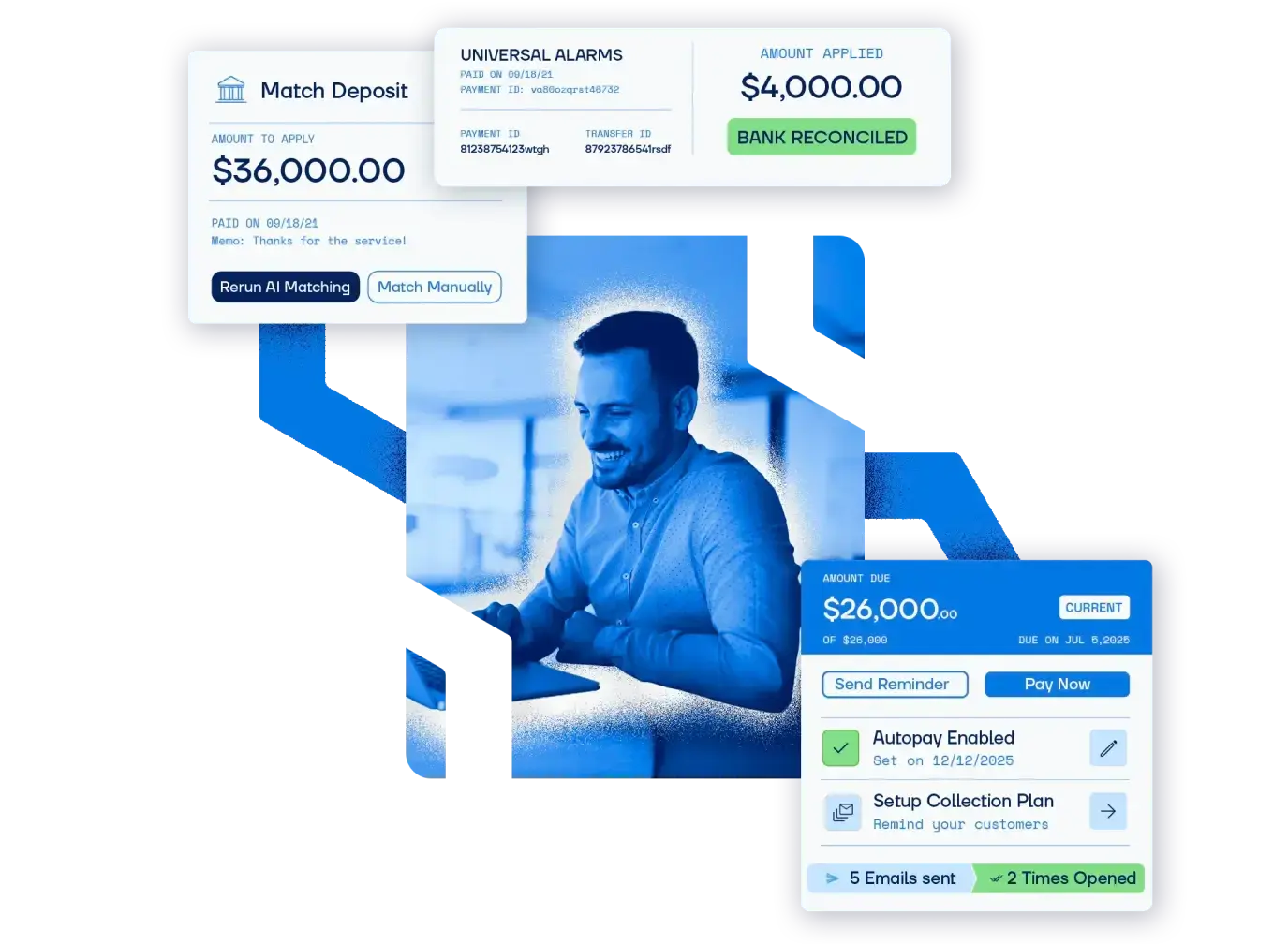

Reconcile payments effortlessly with built-in automation. By leveraging AI-driven reconciliation, companies can minimize human error and speed up financial close cycles.

Improve Cash Flow

Accelerate payments and optimize working capital. Businesses can reduce their reliance on paper checks and outdated invoicing methods, leading to faster payment collections and improved financial efficiency.

Key Features of Paystand’s Acumatica Integration

Avoid the high costs of traditional credit card processing. Paystand’s zero-fee network eliminates unnecessary transaction fees by enabling direct bank-to-bank transfers, reducing overhead, and maximizing profitability. Paystand’s zero-fee payment network leverages bank-to-bank payments, eliminating unnecessary transaction fees while offering a seamless experience within Acumatica.

Accept a variety of payment methods, including ACH, eCheck, and credit card payments, giving customers flexible options.

- Cut dependency on costly card networks with Paystand’s innovative, fee-free payment model.

- Ensure predictable and transparent financial transactions without hidden processing fees.

.webp?width=1681&height=1149&name=A2%20(1).webp)

Intelligent Reconciliation & Automation

Reduce manual entry and human error with automated reconciliation. Traditional payment reconciliation is time-consuming and error-prone. Paystand’s Acumatica integration automates this process by syncing payment data instantly, ensuring real-time visibility into cash flow.

- Automatically match payments to sales orders, invoices, and customer records.

- Reduce reconciliation time from days to minutes with AI-driven automation.

- Enhance financial reporting accuracy by eliminating manual data entry.

Faster, Secure Transactions

Process payments quickly and securely with blockchain-verified transactions. By leveraging blockchain technology, Paystand ensures each transaction is verifiable, fraud-resistant, and fully auditable. Whether you’re handling credit card payments, ACH, or other digital payment methods, Paystand provides a reliable, fraud-resistant solution.

- Enhance security with real-time transaction verification.

- Protect customer and business data with encrypted payment processing.

- Reduce fraud risks with blockchain-backed payment authentication.

How Businesses Benefit from Paystand

Businesses using Paystand’s Acumatica integration experience significant cost savings, increased efficiency, and improved cash flow. Companies across various industries, from manufacturing to wholesale distribution, have reported a dramatic reduction in processing fees and administrative burdens after switching to Paystand. From reducing transaction fees to automating payments and reconciliation, our customers achieve measurable results that drive business growth.

.webp?width=1500&height=1500&name=LunaPic%20Photo%20Edit%20(1).webp)

“We found Paystand so easy to use; their embedded payment links in our invoices are simple for customers. Our clients and vendors are no longer confused at the critical moment when they're ready to pay."

James Allen

CEOGet Started with Seamless Acumatica Integration

Integrating Paystand with Acumatica is simple and straightforward. Our dedicated support team ensures a smooth onboarding process, allowing you to start optimizing payments and cash flow immediately. With a quick setup process and expert guidance, businesses can transition to automated, integrated payment processing without disruptions.

Step 1

Connect Paystand to Acumatica using our seamless API Integration.

Step 2

Configure your preferred payment methods and customize transaction workflows.

Step 3

Automate invoicing, reconciliation, and cash application to reduce manual intervention.

Step 4

Enjoy seamless, zero-fee B2B payments with enhanced financial visibility.

Trusted by Businesses All Across America

Leading businesses across industries rely on Paystand’s Acumatica integration to modernize their payment infrastructure. Whether you’re managing sales orders, processing recurring payments, or optimizing financial workflows, Paystand delivers the efficiency and cost savings you need. From mid-sized enterprises to large corporations, Paystand is helping businesses eliminate payment friction and gain control over their cash flow.

- Manufacturers leverage Paystand to streamline B2B payments and reduce transaction fees.

- Distributors integrate Paystand to improve cash flow and enhance financial forecasting.

- Service providers use Paystand’s automation tools to eliminate manual processing and improve operational efficiency.

What We Do

Take a quick look at how we handle the payment process.

However, if watching videos is not for you, we've added an interactive payment experience at the button below.

Frequently Asked Questions

1. What payment methods does Paystand support in Acumatica?

Paystand supports various payment methods, including ACH, credit card payments, B2B transfers, electronic payment options, and digital payment links. Businesses can customize their payment options to suit their needs best while streamlining their accounts receivable processes.

2. How does Paystand enhance the payment experience in Acumatica?

Paystand automates payment collection, reconciliation, and reporting, eliminating manual processes and reducing errors. Integrated payment processing ensures a seamless experience directly within Acumatica. It even facilitates partial payment capabilities to accommodate diverse customer preferences.

3. Can I customize payment options in Acumatica with Paystand?

Yes, Paystand allows businesses to configure payment options to accept payments through automated payment links, recurring payments, and various bank transfer methods to align with their financial workflows.

4. What is the Acumatica API, and how does it work with Paystand?

The Acumatica API is a robust processing solution that integrates seamlessly with Paystand. It allows for real-time payment processing, data synchronization, and automated reconciliation within the ERP system.

5. What makes Acumatica different from other ERP solutions?

Acumatica Accounting Software offers cloud-based ERP functionality with flexible pricing, real-time financial visibility, and seamless integrations like Paystand. It’s designed for growing businesses seeking scalable, efficient financial management solutions.

Optimize your Acumatica payment processing today with Paystand. Learn more about our seamless, zero-fee integration and take control of your B2B payments.

Integrate Payments In Acumatica

Optimize your Acumatica payment processing today with Paystand. Learn more about our seamless, zero-fee integration and take control of your B2B payments. Contact us today to see how Paystand can transform your payment operations.

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.