Zero fee

-

Solutions

ZERo TOuch

zero time

By INDUSTRY

-

Integrations

Integrations

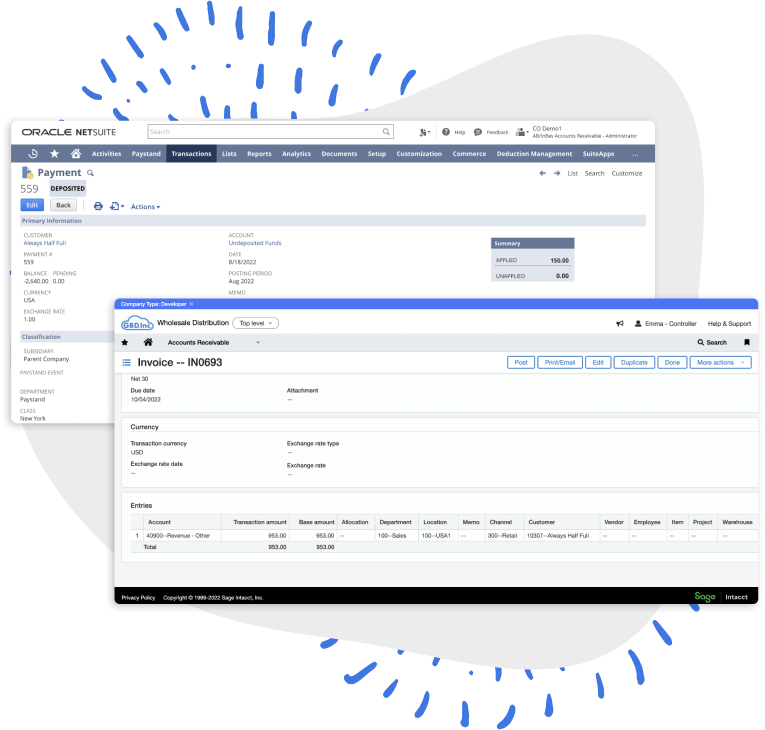

Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record.

Integrations

DATA & INFRASTRUCTURE

-

Resources

Resources

Most AR professionals are searching for new ways to reduce costs, improve cash flow, and optimize their processes. Paystand has curated content to help AR professionals in their quest.

CONTENT BY TYPE

LEARNING RESOURCES

Unlock AI & Blockchain's PowerDiscover how top CFOs are transforming finance with automation, data, and decentralized tech.

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Payments as a ServicePARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

ABOUT US

See how we are rebooting commercial finance.

Where We Operate

United states

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.canada

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

- Solutions

- B2B Payments

- Payment Portal

- Paystand Bank Network

- Smart Lockbox

- Check Scan

- eCheck and ACH

- Canadian EFT

- Billing and Receivables

- Collections Automation

- Convenience Fees

- Accounts Receivables

- Spend Management: Teampay

- Dashboard and Reporting

- Push Payments: AI Match

- Healthcare

- Manufacturing

- Construction

- Supply Chain

- Solar Energies

- Integrations

- Resources

- Company

Streamline Your B2B Payments with Smart Lockbox

Ditch the daily check-run chaos. Paystand's Smart Lockbox turns paper-heavy processes into digital, automated workflows that save time, reduce risk, and accelerate cash flow.

How Smart Lockbox Works

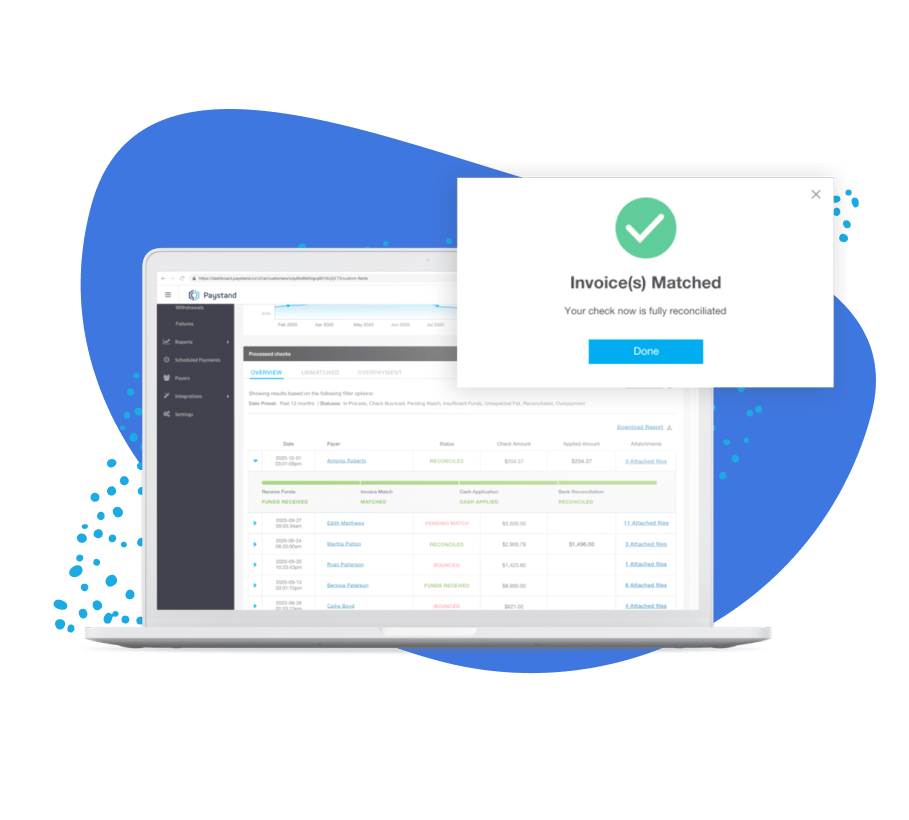

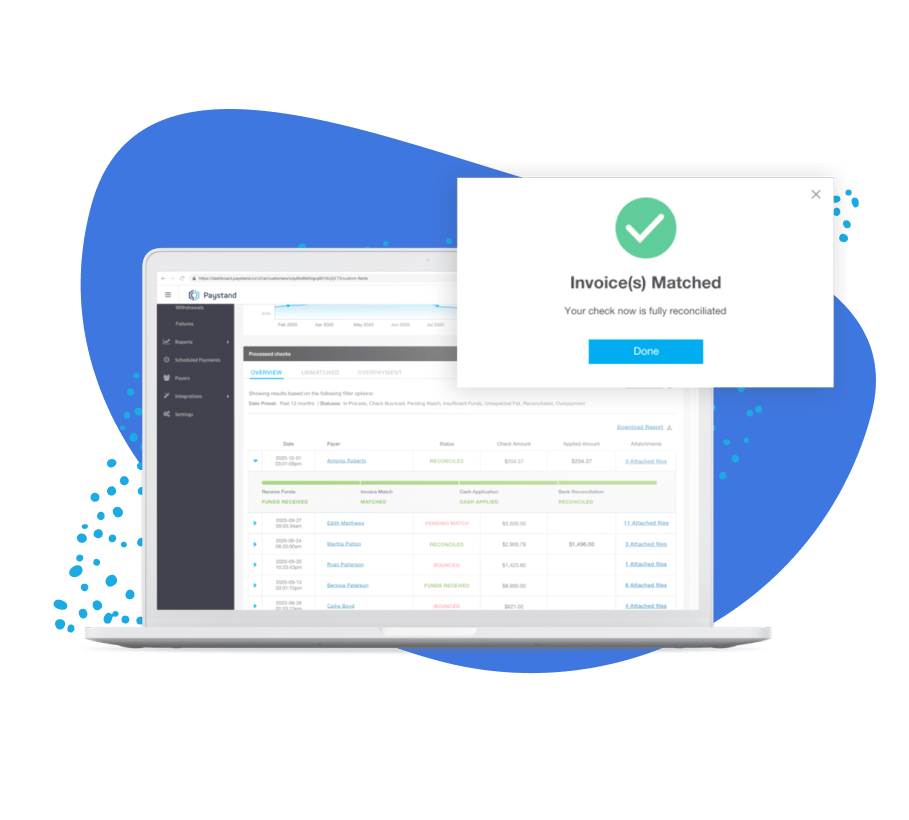

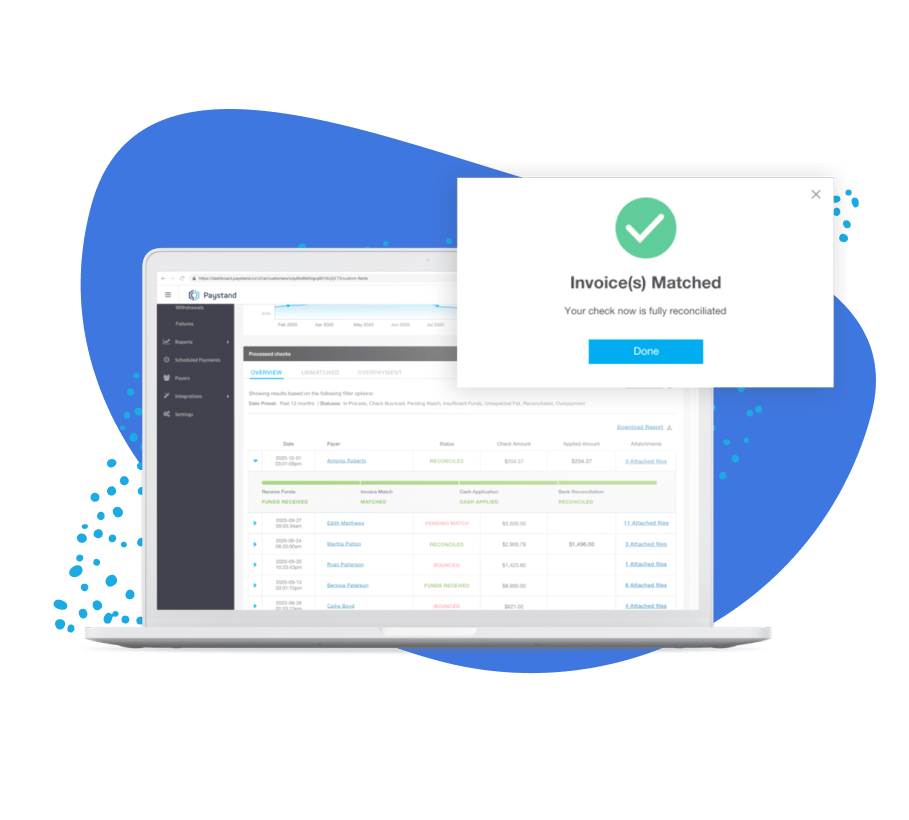

Paystand’s Smart Lockbox accepts payments like checks, eChecks, and credit cards, converting them into instant digital transactions. It integrates with your accounting software, reducing reconciliation from days to minutes.

Universal Ingestion

Whether it's a mailed check or an emailed remittance, our Smart Lockbox automatically ingests, digitizes, and deposits funds.

Hands-Off Reconciliation

Lockbox transaction software integrates with your ERP, automating matching and eliminating manual data entry.

End-to-End Visibility

Real-time dashboards show you where your money is at every stage, making lockbox payment processing a whole lot less mysterious.

E-BOOK

The Guide to Lockbox Reinvention

Modern B2B payments need a lockbox that goes beyond scanning and emailing. Paystand’s Smart Lockbox automates data capture, removes bottlenecks, and provides a real-time cash flow overview, allowing your AR team to focus on strategy instead of spreadsheets.

Get the full story now!

Common Lockbox Pain Points, Solved

Legacy lockbox payment services often look modern, but they still operate like it’s 1999. Paystand was built to change that.

- Slow deposit times: Traditional banks batch and delay deposits. Our Smart Lockbox gets your funds flowing faster with same-day processing.

- Hidden fees: You shouldn’t be penalized for getting paid. Say goodbye to surprise fees baked into every transaction.

- Manual intervention: Old-school lockboxes require staff to scan, upload, or key in data manually. Paystand automates the entire flow.

- Limited payment options: Whether it's paper checks or digital payments, Paystand’s Smart Lockbox handles them all, without the need for multiple vendors.

Why Smart Lockbox from Paystand

CASE STUDY

Super7 Streamlined AR and Scaled Without Increasing Headcount

Super7, a fast-growing pop culture collectibles brand, struggled with its accounts receivable process. Manual check handling and slow reconciliation threatened their momentum.

By using Paystand’s Smart Lockbox, Super7 automates payment intake via eChecks, paper checks, and credit cards. Payment data flows directly into their ERP, saving hours weekly, reducing errors, and providing real-time cash visibility.

ON-DEMAND WEBINAR

Unlock Your AR Potential

Still battling paper checks? You're not alone, and there's a better way forward.

Our webinar, Solving Paper Checks with Smart Lockbox, explores how finance teams are replacing envelopes and scanners with automated, digitized workflows. Gain insights into the costs of manual processes, hidden inefficiencies in collections, and how a Smart Lockbox shifts AR from reactive to strategic.

Frequently Asked Questions

Q1. How does digital lockbox automation work?

Digital lockbox automation turns incoming payments, like paper checks, eChecks, or credit card transactions, into digital entries. It scans, digitizes, deposits funds, and syncs this data with your accounting software.

2. Are digital lockboxes only for checks?

Not at all. While many systems only handle paper checks, Paystand’s Smart Lockbox processes various payment types, like eChecks, ACH, wire transfers, and credit cards, in one system.

3. How much is a lockbox at a bank?

Bank lockbox services can be expensive, with monthly fees and processing charges often exceeding hundreds of dollars. Paystand provides transparent, flat-rate pricing with no hidden fees, helping you manage your AR costs more effectively.

4. What is the difference between a lockbox and a P.O. box?

A P.O. box is a mailing address. A lockbox is a secure payment service that collects payments, deposits them into your account, and captures data for reconciliation. It's like the difference between picking up your mail and having someone instantly open, deposit, and log it for you.

5. Can lockboxes process both paper and digital payments?

Yes. Paystand’s Smart Lockbox combines physical and digital payment channels into one intelligent system. Payments via mail or email are processed quickly, ensuring visibility and control.

6. Does Smart Lockbox integrate with my ERP?

Yes. Paystand integrates with top ERP and accounting software such as NetSuite, Sage Intacct, and Microsoft Dynamics 365. Payment data transmits automatically from lockbox to ledger, eliminating human handoffs.

7. What businesses benefit from a smart lockbox?

Smart lockbox services benefit businesses with high receivables, like manufacturing, construction, technology, healthcare, and financial services, by enhancing cash flow, reducing AR overhead, and improving data accuracy.

8. Is Paystand Smart Lockbox secure?

Paystand uses enterprise-grade encryption, tokenization, and role-based access. Every transaction is logged and audit-friendly, ensuring compliance and protecting sensitive data.

Ready to Automate Your Receivables?

It's time to leave manual processes behind! With Paystand’s Smart Lockbox, you can effortlessly transition your AR into a bright digital future, smoothly, smartly, and seamlessly.

Make the switch, ditch the paper, keep the cash flow.

Get Smart Lockbox today

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.

- Solutions

- B2B Payments

- Payment Portal

- Paystand Bank Network

- Smart Lockbox

- Check Scan

- eCheck and ACH

- CAD EFT

- Billing & Receivables Automation

- Collections Automation

- Convenience Fees

- Spend Management

- Accounts Receivables

- Dashboard and Reporting

- Push Payments: AI Match

- Healthcare

- Manufacturing

- Construction

- Supply Chain

- Solar Energies