Zero fee

-

Solutions

ZERo TOuch

zero time

-

Integrations

Integrations

Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record.

Integrations

DATA & INFRASTRUCTURE

-

Resources

Resources

Most AR professionals are searching for new ways to reduce costs, improve cash flow, and optimize their processes. Paystand has curated content to help AR professionals in their quest.

CONTENT BY TYPE

LEARNING RESOURCES

Unlock AI & Blockchain's PowerDiscover how top CFOs are transforming finance with automation, data, and decentralized tech.

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Payments as a ServicePARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

ABOUT US

See how we are rebooting commercial finance.

Where We Operate

United states

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.canada

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

- Solutions

- B2B Payments

- Payment Portal

- Paystand Bank Network

- Smart Lockbox

- Check Scan

- eCheck and ACH

- Canadian EFT

- Billing and Receivables

- Collections Automation

- Convenience Fees

- Accounts Receivables

- Spend Management: Teampay

- Dashboard and Reporting

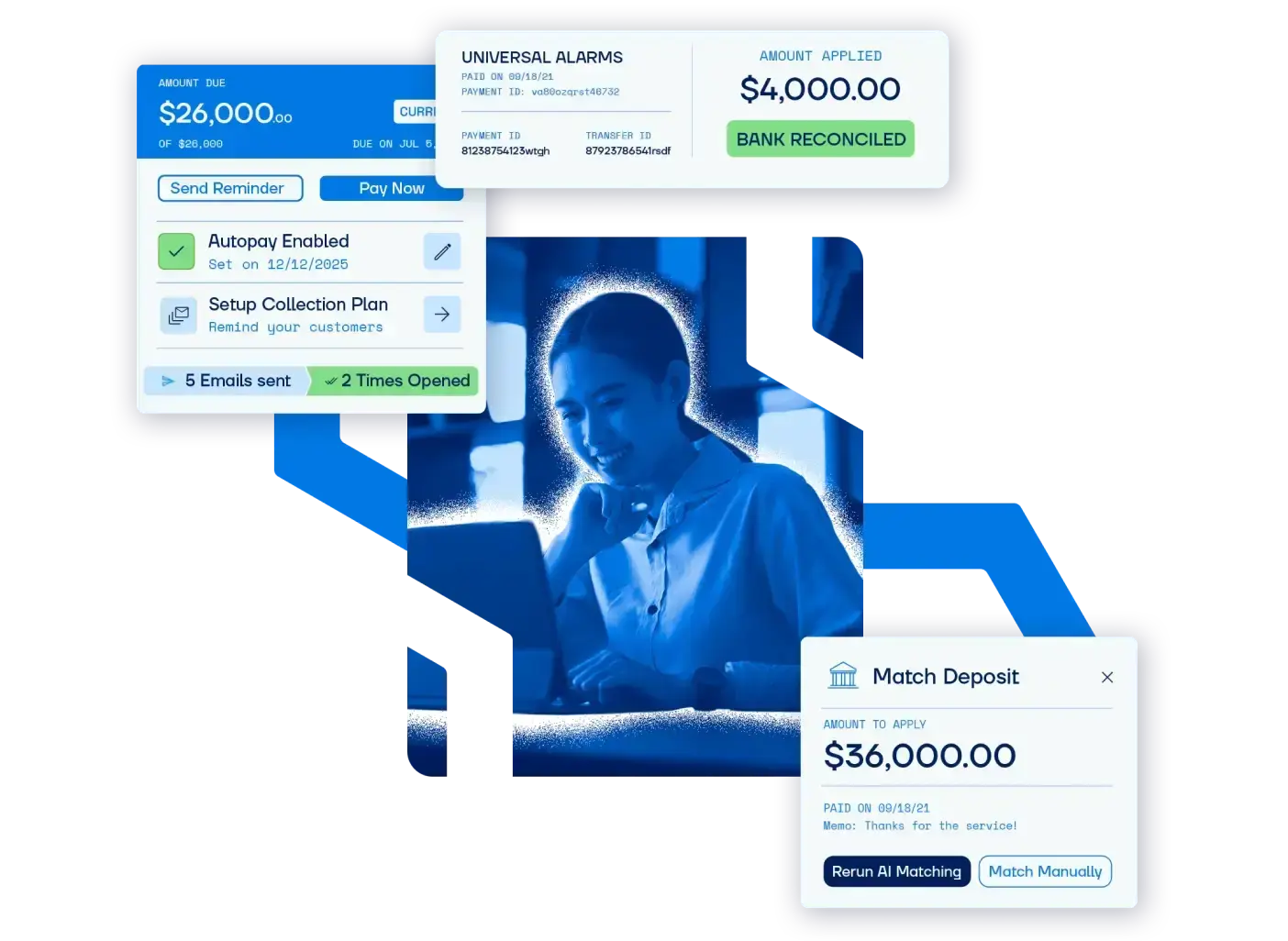

- Push Payments: AI Match

- Healthcare

- Manufacturing

- Construction

- Supply Chain

- Solar Energies

- Integrations

- Resources

- Company

Sage Intacct AP & AR Automation Integration for Seamless Workflows

Automate accounts payable and receivable directly inside Sage Intacct. Eliminate manual processes, reduce errors, and accelerate cash flow with Paystand, a Sage Intacct Payment Integration built for modern finance teams.

Why Automate AR & AP in Sage Intacct?

Automated Invoice Processing

Eliminate time-consuming manual data entry.

Cash Application

Match payments to invoices in real time for faster reconciliation.

Approval Workflows

Streamline AP and AR approvals directly inside Sage Intacct.

Payment Methods

Accept ACH, bank-to-bank, and credit card payments securely.

Save Time & Money

Reduce processing time, errors, and improve cash flow.

Real-Time Visibility

Track accounts payable and receivable across your finance team.

Get Paid Faster in Sage Intacct

Speed up collections with embedded “Pay Now” buttons, branded portals, and flexible payment methods. Paystand reduces DSO by up to 60% while improving customer payment experience. Reconciliation happens automatically — even partial or multi-invoice payments apply instantly.

Simplify Vendor Payments in Sage Intacct

Pay vendors directly from approved Sage Intacct bills. Payments settle digitally, remittance advice is sent automatically, and books are updated in real time. No more duplicate data entry, delays, or errors.

Seamless Sage Intacct Integration for Billing Automation

Payment reconciliation and reporting should be simple. Paystand integrates payments in real time, automating AR and AP in Sage Intacct.- Sync payments and automate bank transfers for real-time reconciliation.

- Access additional integrations via Sage Intacct Marketplace.

- Control payment options, track invoices, and report from one dashboard.

Seamless Sage Intacct Integration for Billing Automation

Payment reconciliation and reporting should be simple. Paystand integrates payments in real time, automating AR and AP in Sage Intacct.- Sync payments and automate bank transfers for real-time reconciliation.

- Access additional integrations via Sage Intacct Marketplace.

- Control payment options, track invoices, and report from one dashboard.

Why Businesses Choose Paystand for Sage Intacct

Growing businesses need scalable payment solutions. Paystand helps companies eliminate manual processes and improve cash flow security.

- Faster time-to-cash: Reduce DSO by 60% or more with automated collections.

- Secure and compliant: Minimize fraud risk with advanced authentication and fund verification.

- Customizable workflows: Customize your payment process with flexible rules and expert support.

- Scalable for growth: Ideal for multi-entity enterprises using cloud-based ERP software.

.webp?width=1681&height=1121&name=Sage%203%20(1).webp)

Unlock Sage Intacct Payment Best Practices

Optimize your Sage Intacct payments with proven strategies. Learn how to streamline transactions, reduce costs, and enhance your cash flow with automation and modern payment methods.Explore Our Integrations

Slack

Automate spend approvals in Slack.

Microsoft Teams

Review and approve spend in Teams.

QuickBooks Online

Automate reconciliation in QBO.

NetSuite

Automate AR & AP inside NetSuite.

Microsoft Dynamics 365

Control spend inside Dynamics.

All Integrations

View all Paystand ERP and finance integrations.

Frequently Asked Questions

1. What is the Paystand integration for Sage Intacct?

Paystand provides AP & AR automation directly inside Sage Intacct. Accept digital payments, automate collections, process vendor bills, and sync transactions in real time, using AP automation software to streamline accounts payable processes.

2. What payment methods are supported?

Paystand supports zero-fee bank payments over the Paystand Bank Network, ACH, debit, and credit cards — covering a wide range of payment processes, with Least-Cost Routing to reduce processing fees.

3. How secure is the integration?

Paystand uses tokenization, bank-level encryption, and role-based permissions to protect sensitive payment data and ensure compliance.

4. How will the integration improve AR performance?

Customers pay faster with embedded links and branded portals. Businesses typically see a 60% reduction in DSO.

5. Is reconciliation automated in AR?

Yes. Payments and daily transfers reconcile automatically in Sage Intacct, with invoices updated in real time.

6. Can customers pay multiple invoices at once?

Yes. Customers can select and pay multiple invoices in one transaction, improving convenience and boosting cash flow.

7. Can we initiate vendor payments directly from Sage Intacct?

Yes. Once bills are approved, payments are initiated from Sage Intacct via ACH or other digital methods.

8. Will AP payments reconcile automatically?

Absolutely. Payments settle and sync back into Sage Intacct, helping you close books faster.

9. Does Paystand send remittance advice to vendors?

Yes. Vendors automatically receive remittance notices with payment details, reducing follow-up calls.

Start Automating Payments in Sage Intacct

Manual processes, transaction fees, and slow payments can change. With Paystand’s Sage Intacct integration, streamline AR, cut costs, and get paid faster—keeping control over your cash flow.

Discover how Paystand can transform your Sage Intacct AR automation and start saving on transaction costs while improving financial management.

Talk to our Sage Intacct experts today

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.

- Solutions

- B2B Payments

- Payment Portal

- Paystand Bank Network

- Smart Lockbox

- Check Scan

- eCheck and ACH

- CAD EFT

- Billing & Receivables Automation

- Collections Automation

- Convenience Fees

- Spend Management

- Accounts Receivables

- Dashboard and Reporting

- Push Payments: AI Match

- Healthcare

- Manufacturing

- Construction

- Supply Chain

- Solar Energies