SMART CHECKOUT

-

Solutions

Solutions

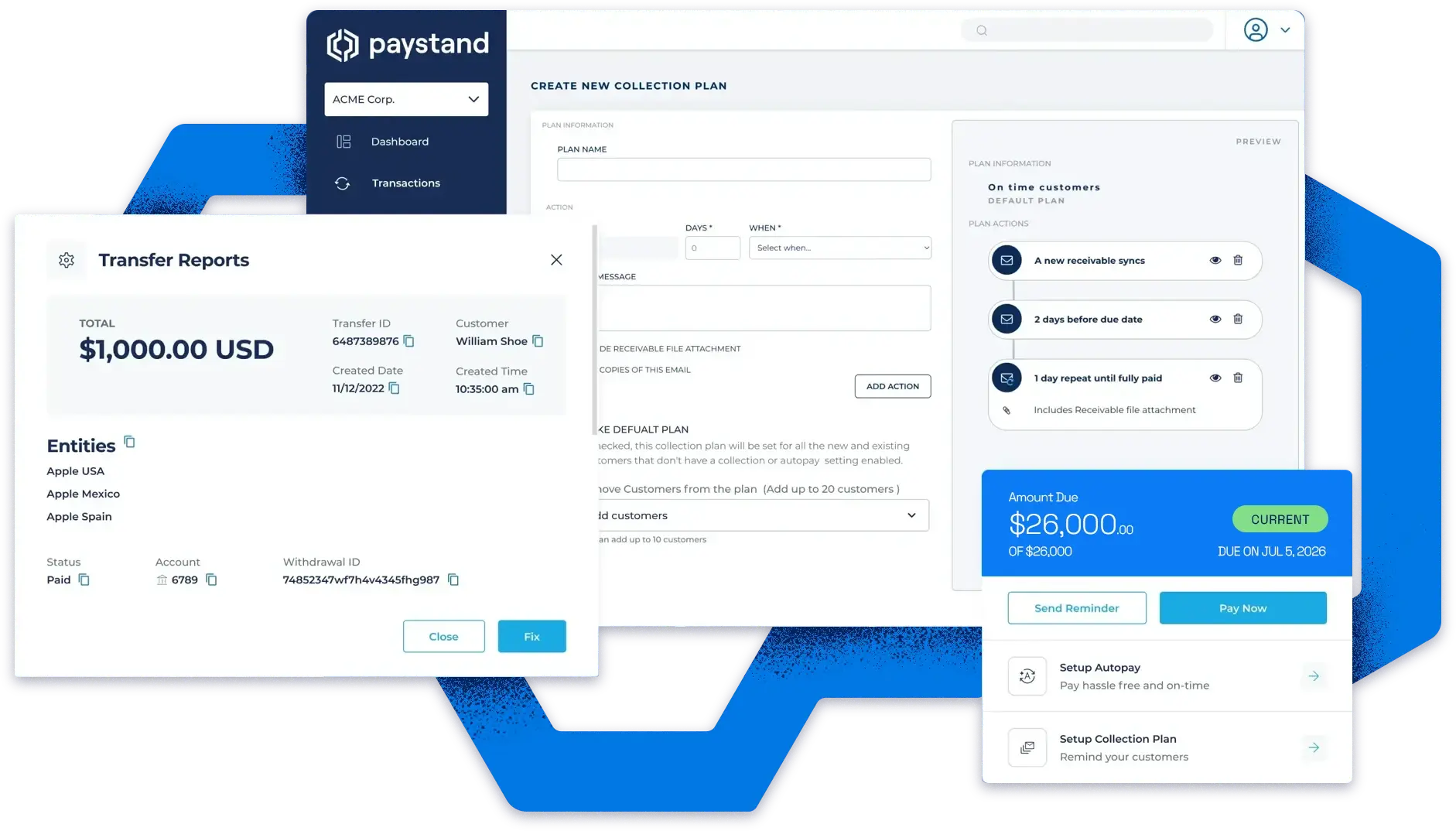

Unlock radically better economics by incentivizing profitable outcomes through fee-less and automated AR processes.

SMART COLLECTIONS

SMART DATA

-

Integrations

Integrations

Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record.

Integrations

NetSuite Best Practices Kit

Learn the key elements for automating payments within NetSuite to streamline your payments process.

-

Resources

Resources

Most AR professionals are searching for new ways to reduce costs, improve cash flow, and optimize their processes. Paystand has curated content to help AR professionals in their quest.

CONTENT BY TYPE

LEARNING RESOURCES

The Future of FinanceUncover the trends, tools, and strategies you need to stay ahead of the curve.

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Learn About Our MissionPARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

CONTACT

Talk to the Paystand team today.

sales@paystand.com

(800) 708-6413Where We Operate

United states

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.canada

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

Smarter Billing & Payment Automation with Paystand

Eliminate spreadsheets and manual tasks. Paystand’s Billing & Payment Automation platform streamlines invoicing and collections, enhances cash flow, reduces errors, and saves your team valuable time.

Ditch the Manual Grind

Manual invoicing and payments are tedious, expensive, error-prone, and slow. Paystand’s Billing & Payment Automation platform replaces outdated processes with electronic invoice automation, making every billing cycle faster, more reliable, and easier to scale.

Automating your billing and payments with Paystand means eliminating friction at every step of the process.

Payment Processing Automation That Moves Money Faster

Traditional payment processing is full of friction. With Paystand, you get seamless, end-to-end payment processing automation: from payment reminders to fund settlement.

Our system ensures that automated payments flow directly into your ERP, keeping your books clean and your cash moving. With Paystand you can

- Eliminate manual matching

- Reduce payment cycles

- Automate billing and payments to boost your cash flow

%20(1)%20copy.webp?width=432&height=558&name=Accountant%20(2)%20(1)%20copy.webp)

Automated Billing Systems Built for Scale

From invoice generation to reconciliation, every step is optimized to reduce costs and increase speed. Our solution automates billing and transforms your AR operations with online payment processing, reducing DSO and eliminating busywork.

Your business deserves a better way to bill. Paystand's automated billing software turns manual processes into streamlined payment workflows.

Why Automate with Paystand?

Automation transforms finance team operations. Paystand’s platform reimagines billing as a strategic function rather than a chore.

SMARTER CASH FLOW

Automated billing and payments mean fewer delays, less revenue stuck in limbo, and more predictable income streams. Your team can count on timely payments and plan budgets with confidence.

OPERATIONAL CLARITY

With real-time dashboards and ERP integration, finance teams gain full visibility into payment status, invoice tracking, and exceptions. No more guesswork or fragmented data.

STRATEGIC EFFICIENCY

Free from repetitive manual tasks, teams can focus on higher-value initiatives like forecasting, financial planning, and growth strategies instead of chasing checks.

COST OPTIMIZATION

Smart payment routing and automation help you reduce transaction fees and eliminate costly reconciliation errors, all while scaling without adding headcount.

Frequently Asked Questions

1. What is an automated billing system, and how does it work?

An automated billing system uses software to generate, send, and manage invoices. It automates the entire billing cycle, from invoice creation and approval to payment processing and reconciliation. By eliminating manual entry, these systems reduce errors, speed up collections, and ensure accurate financial reporting. Paystand’s automated billing software integrates seamlessly with your ERP, giving your team real-time insight into payment statuses and outstanding invoices.

2. What are the key benefits of using payment automation?

Payment automation delivers faster transactions, fewer errors, and improved working capital. By replacing manual tasks with streamlined payment workflows, businesses can minimize human intervention and maximize accuracy. It reduces labor costs, accelerates receivables, and ensures compliance with audit-ready transaction records. With Paystand, you also benefit from smart routing and payment optimization, improving operational efficiency.

3. What’s the difference between automated billing and traditional billing methods?

Traditional billing depends on paper invoices, manual processing, and follow-up phone calls, leading to delays, errors, and inefficiencies. On the other hand, automated billing systems use billing automation software to create and distribute digital invoices instantly, track payments in real time, and reconcile data automatically. This boosts productivity and improves customer experience through faster and more accurate billing.

4. Can automated payments improve my business cash flow?

Automated payments ensure your business gets paid faster by minimizing friction in the collections process. They eliminate bottlenecks caused by manual approvals or processing, reduce late payments through automated reminders, and give your team better visibility into incoming cash. The result is more predictable, healthier cash flow that supports smarter business decisions.

5. How does automated invoicing help reduce errors and manual work?

Electronic invoice automation eliminates repetitive tasks like manual data entry, invoice printing, and mailing. Digitizing the invoicing process reduces human error, speeds up approval cycles, and ensures invoice accuracy. Paystand’s solution also flags discrepancies automatically, allowing finance teams to resolve issues quickly and maintain consistent, audit-ready records.

#OPENINDUSTRY

Robust ERP Integrations

Your transaction data shouldn't be siloed. Integrate your B2B payments with your critical business tools: ERP, eCommerce, CRM, and accounting systems.

- Send invoices with embedded payment links

- Use smart data to attach key invoice information to every payment

- Auto-reconcile transactions directly in your system of record

Ready to Automate Your Receivables?

Modernize your financial operations with Paystand. Experience the power of automated billing systems and smarter online payment processing on a unified platform.

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.