ACCOUNTS RECEIVABLES

- Receivables

-

Payables

ACCOUNTS payables

WHY NOW

Our push into Accounts Payables comes with our mission of becoming the one stop shop for the CFO.

By integrating AP, our financial suite becomes even more powerful as we aim to automate everything money.

-

Payments

OUR NETWORK

Discover how we enable your business to receive fee-less payments at a faster speed than your current solution.

We transition your costliest payers into cost-effective payment rails to return the most positive of ROIs.

- Expense

-

Resources

DATA & INFRASTRUCTURE

LEARNING RESOURCES

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Payments as a ServicePARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

ABOUT US

See how we are rebooting commercial finance.

Where We Operate

United states

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.canada

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

CUT FEES, BOOST MARGINS. LET PAYSTAND HELP YOU DO BOTH.

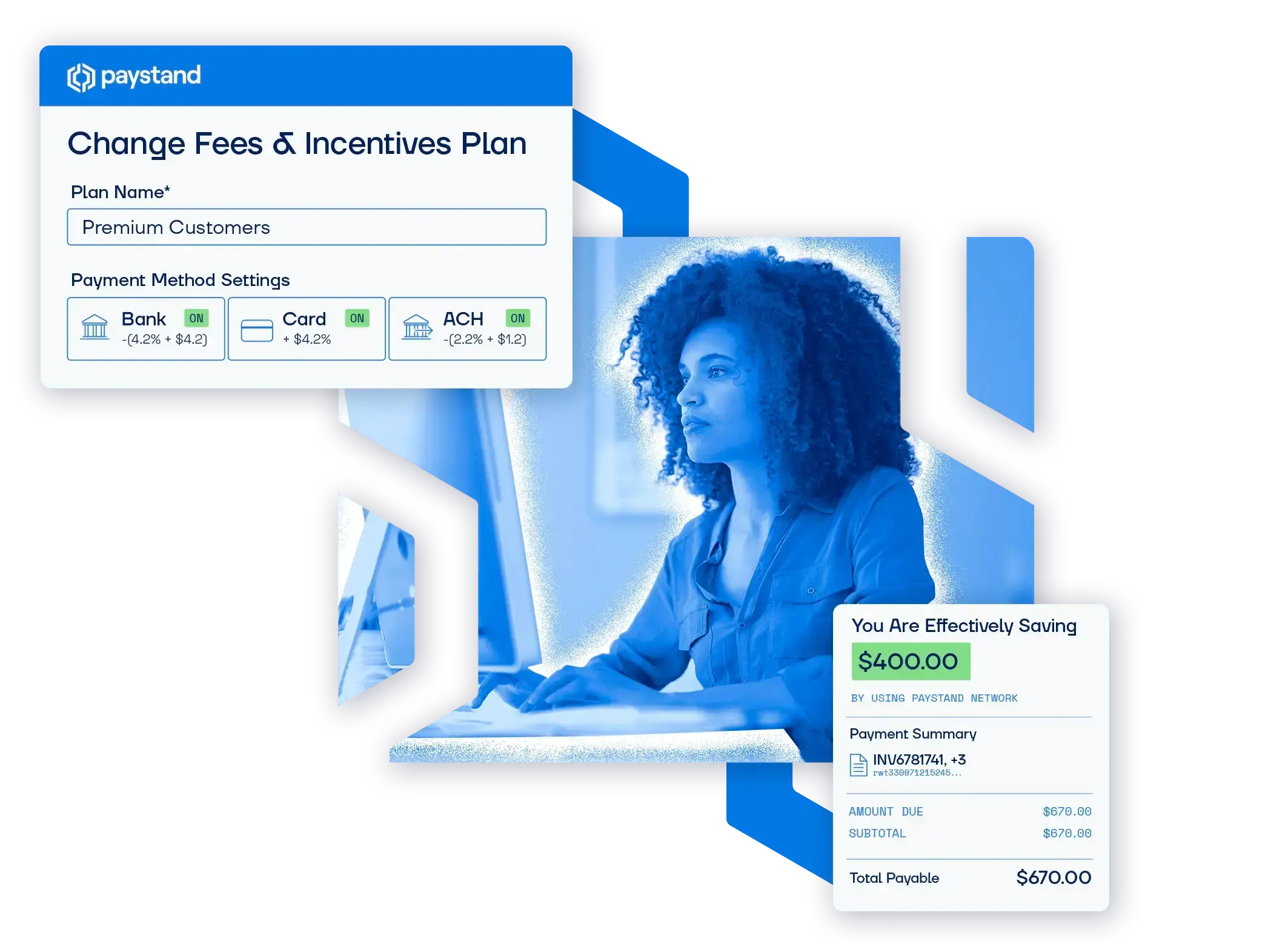

B2B Convenience Fees and Incentives That Drive Growth

In B2B payments, processing fees are inevitable. But what if you could make them work for you?

Paystand helps you cover the cost of payments, encourages early payments, and unlocks new efficiencies without passing hidden fees to your business.

Why Fees and Incentives Matter in B2B Payments

Make payers part of the solution

Offer multiple payment options and let customers choose how they want to pay, with clarity on fees and incentives for every method.

Avoid compliance pitfalls

We don’t do surcharging. Instead, we guide you on when and how to apply convenience fees legally and ethically, helping you stay compliant across states.

What Makes Paystand Different

Most payment processors aren’t built for the realities of B2B. Their pricing is opaque, their systems are clunky, and their incentives are misaligned with yours. Paystand flips that model on its head.

We help you reduce transaction costs, boost the payer experience, and leave clunky fee models in the past. Here’s how Paystand changes the game:

- Pass Fees Without Losing Trust: 70% of Paystand users pass fees transparently—protect margins without damaging customer relationships.

- Incentivize Faster Payments: Digital incentives help customers pay up to 2x faster. Paystand automates it based on timing, method, or behavior.

- Flat Rates = No Surprises: Simplify your pricing with predictable, flat-rate fees—no more cash flow guesswork.

- Truly No Hidden Fees: No gateway, PCI, or “mystery” charges. Paystand keeps pricing 100% transparent.

Don’t Let Transaction Fees Drain Your Revenue

Every payment your business processes incurs transaction fees that eat into revenue. Credit card networks, banks, and payment processors can charge up to 5% per transaction, reducing profits with each paid invoice.

For growing B2B companies, these fees scale with your revenue, but they’re not inevitable. Switching to an automated, feeless payment infrastructure helps eliminate:

- Interchange and processing fees

- Hidden gateway and settlement costs

- Delays from outdated payment systems

Rethink how your business gets paid and keep 100% of what you earn. Paystand helps eliminate transaction fees with a feeless, automated payment network for modern B2B finance.

"Real-time updates and analytics have made it easier to forecast and budget cash flow."

CHAD BELLO

Revenue Accounting Manager

"So easy to use; their embedded payment links in our invoices are simple for customers. Our clients are no longer confused at the critical moment when they're ready to pay."

JAMES ALLEN

CEO

"Paystand allows us to free up resources, reduce costs, expedite payments with real-time transaction posting, and have confidence that our AR process is equipped to handle growth."

KRISTEN PARISIEN

Controller

"Since working with Paystand, we’ve saved almost 20 hours of work a week."

See how Motorola reduced costs by 16%.

SOFIA MITCHELL

Accounting Analyst

"Seeing our DSO metric drop year after year after implementing Paystand and eliminating manual AR has been game-changing."

Ben Cole

President

"It's almost creepy how easy Paystand makes my job. It's unbelievable how automated it is. It's been an even better experience than we anticipated... We just fully trust Paystand."

JOHN DYBWAD

Vice President of Finance & Budget

Real Impact, Real Results

Don’t just take our word for it. Businesses across industries are using Paystand’s fees and incentives features to streamline their cash flow, eliminate late payments, and bring predictability to their payment processes.

Here’s how others are doing it:

- Covetrus implemented a transparent convenience fee model with Paystand. By clearly communicating fee structures and offering a zero-fee alternative, they covered processing costs on card payments without disrupting customer relationships.

- Choozle, a digital ad platform, turned late payments into early payments with a tailored early-pay discount strategy powered by Paystand. Within three months, they saw a 40% increase in payments made within net terms.

Frequently Asked Questions

1. What’s the difference between convenience fees and surcharges?

While both involve passing some cost to the customer, convenience fees and surcharges aren’t interchangeable, and understanding the distinction is key to staying compliant.

- A convenience fee applies when a business offers an optional payment method other than usual channels, such as credit card payments instead of checks or ACH.

- A surcharge is a fee for using a credit card, and it’s tricky. Surcharging is regulated and banned in several U.S. states.

At Paystand, we don’t support surcharging. Instead, we help you implement legal, transparent convenience fee strategies that give customers flexibility while allowing you cover the cost of payment services without putting your compliance at risk.

2. How can I avoid convenience fees altogether?

If you prefer not to pass fees to customers, consider incentivizing low-cost payment methods like bank transfers or ACH over higher-cost options such as credit cards.

Paystand streamlines transactions with intelligent payment routing and zero-fee options, encouraging customers to choose methods without transaction fees. Automate payer incentives to direct customers toward preferred methods, eliminating convenience fees and preserving margins.

3. What’s the best way to manage late payments?

Late payments are a chronic pain in B2B, costing time, revenue, and sanity. The best way to tackle them is to make payments faster, easier, and more rewarding for your customers. Paystand automates reminders, offers early-pay incentives, and provides a streamlined digital payment experience, reducing friction. It also communicates late payment fees upfront, fostering transparency and accountability without harming relationships.

4. When should I use payer incentives in the payment process?

Payer incentives are powerful tools for steering behavior and improving outcomes, especially when reducing transaction costs or accelerating payments.

You should consider using incentives to:

- Encourage digital payments over checks.

- Reduce credit card usage and merchant fees.

- Motivate early payments and shorten DSO.

- Offer flexible options that benefit your business and customers.

With Paystand, you can integrate incentives into your payment process by offering zero-fee methods, early-pay discounts, or preferred rates based on method and timing. It’s a win-win: you get paid faster, and customers feel they are getting a better deal.

Take Control of Fees and Incentives

You shouldn’t be at the mercy of your merchant fee structure or left holding the bag for every transaction charge. With Paystand, you gain control over your payment costs, provide better payer experiences, and unlock new ways to grow without compromise.

Put your payment strategy to work.

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.