Merchant Account: A Modern Business Solution

In today's digital age, businesses must offer various payment options to accommodate customers' preferences. While cash, paper checks, and debit cards were once the standard, credit cards have become increasingly popular in recent years. However, even credit card payments are starting to fall behind with the advent of ACH and bank-to-bank transfers, which offer a more seamless and efficient payment processing experience.

Accepting ACH and bank-to-bank transfers can be a significant advantage for small business owners. These payment methods are typically faster and less expensive than credit card payments and can also be more secure. However, a small business owner must invest in a merchant account to accept ACH and bank-to-bank transfers.

What is a Merchant Account?

A merchant account is a type of bank account that allows a business to accept digital B2B payments. Banks or payment processors typically charge various fees for merchant accounts, varying depending on the provider and the type of merchant account.

In addition to the fees, there are a few other things that a small business owner should consider when choosing a merchant account. These include:

- Reputation. Choosing a merchant account provider with a good reputation and who is known for providing reliable service is essential.

- Customer service. It should be available to answer any questions or concerns a business may have.

- Security measures. Strong security measures protect a business’s financial information.

By choosing the right merchant account provider, businesses can ensure that they can accept ACH and bank-to-bank transfers securely and efficiently.

Types of Merchant Accounts

A merchant account is a type of bank account that allows businesses to accept credit and debit card payments. There are several types of merchant accounts, each with its features and benefits.

- Retail Merchant Accounts are designed for businesses that sell goods or services in a physical store. These accounts typically require a monthly fee and a per-transaction fee.

- E-commerce Merchant Accounts are designed for businesses that sell goods or services online. These accounts typically require a monthly or per-transaction fee and additional security features like SSL encryption.

- MOTO (mail order/telephone order) Merchant Accounts are designed for businesses that take orders over the phone or through the mail. These accounts typically require a monthly fee and a per-transaction fee.

- Mobile Merchant Accounts are designed for businesses that want to accept online transactions on mobile devices such as smartphones and tablets. These accounts typically require a monthly minimum fee.

- Wholesale Merchant Accounts are designed for businesses that sell goods or services to other businesses. These accounts typically require a monthly fee and a per-transaction fee, as well as additional features such as the ability to process large transactions.

- High-risk Merchant Accounts are designed for businesses at high risk for fraud or chargebacks. These accounts typically require a higher monthly fee, a higher per-transaction fee, and additional security features.

Benefits of a Merchant Account

- Boost Your Revenue. A merchant account can enhance your revenue stream by accepting various payment methods. With options like credit cards, debit cards, ACH, and bank transfers, you can simplify purchasing for a broader customer base, potentially leading to increased sales.

- Enhance Customer Satisfaction. Depending on your merchant portal, you may have additional features to improve the customer experience. These can include:

- Customized invoices and branded payment portals

- Ability to save payment information for future use

- Partial payment options

- Streamline Business Operations. A merchant account commonly offers business-specific features that can simplify accounting, such as:

- Invoice automation

- Automated collections

- Payment portals

- Enhanced analytics tools

- Point-of-sale options

- Integrations with ERP or accounting software

- Secure payment processing

- Automated and verified receipts

- Recurring payment options

- Build Brand Credibility. Seamless payment portals and branded payment gateways present a professional image to your customers. A well-designed payment experience can instill trust in your brand and foster customer loyalty.

- Secure Payment Processing. Choose a merchant account that guarantees compliance with PCI DSS standards to ensure your customers' payment information security. Cybersecurity is crucial in the digital age, as consumers are increasingly susceptible to online fraud.

- Accurate Accounting. Integrating your merchant account with your ERP or accounting software or using it independently provides a clear record of transactions. This can aid in forecasting and preparing for tax season.

- Cash Flow Insights. Accurate accounting also offers insights into your cash flow, potentially in real time. Many online merchant accounts provide enhanced analytics on DSO, turnover ratio, collection effectiveness index (CEI) metrics, and more.

How to Get a Merchant Account?

A merchant account is crucial for businesses that wish to accept credit cards and debit card payments. Here are the key steps involved in obtaining a merchant account:

1. Understand Your Business Needs

- Identify the types of payments you plan to accept.

- Determine your transaction volume and average ticket size.

- Assess your risk profile based on industry, product type, and customer base.

2. Choosing the Right Payment Processor

- Research different payment processors and compare their offerings, fees, and customer support.

- Consider factors such as security measures, fraud protection, and integration options.

- Select a payment processor that aligns with your business needs and budget.

3. Gather Necessary Documentation

- Prepare your business registration documents, bank statements, and tax identification numbers.

- Provide information about your business owners, directors, and key personnel.

- Collect details about your products or services, including pricing and shipping policies.

4. Apply for a Merchant Account

- Contact the payment processor you've chosen and request a merchant account application.

- Fill out the application accurately and thoroughly, providing all the required information.

- Apply along with the necessary documentation.

5. Underwriting Process

- The payment processor will review your application and conduct an underwriting process to assess your business's risk.

- They may request additional documentation or information if needed.

6. Approval and Setup

- The payment processor will provide a merchant account agreement if your application is approved.

- Review the agreement carefully and sign it to establish the merchant account.

- Set up your payment processing system by integrating it with your website or point-of-sale system.

7. Testing and Activation

- Conduct thorough testing to ensure the payment processing system is functioning correctly.

- Process test transactions to verify that payments are processed successfully.

- Activate your merchant account once testing is complete.

8. Ongoing Monitoring and Compliance

- Regularly monitor your merchant account to track transactions, chargebacks, and other activities.

- Comply with the payment processor's terms and conditions and maintain industry standards.

- Stay updated with any changes in regulations or security protocols.

9. Managing Chargebacks and Disputes

- Understand the chargeback process and how to handle chargebacks effectively.

- Respond to chargebacks promptly and provide the necessary documentation.

- Work with the payment processor to minimize chargebacks and protect your business.

10. Customer Service and Support

- Leverage the customer service and support provided by the payment processor.

- Contact customer support for technical issues, account inquiries, or disputes.

By following these steps and working closely with a reliable payment processor, businesses can obtain a merchant account and accept credit and debit card payments, enhancing customer convenience and revenue opportunities.

What is the Cost of a Merchant Account?

The cost of a merchant account can vary depending on several factors, including the type of account, the provider, and the volume of transactions. Here are some of the key factors that can affect the cost of a merchant account:

- Type of account

- Provider

- Transaction volume

- Pricing models

The cost of a merchant account can be a significant expense for businesses. Before choosing a provider, it's important to factor in all of the costs associated with a merchant account.

What Are Merchant Account Fees?

Merchant account fees are charges associated with accepting credit and debit cards as payment for goods or services. These fees can vary depending on the payment processor, the card type, and the transaction amount. Some common merchant account fees include:

- Processing fees are charged by the payment processor for each transaction. The fee is typically a percentage of the transaction amount.

- Interchange fees are charged by the card issuer to the merchant's bank and are typically fixed per transaction.

- Assessment fees are charged by the card networks (Visa, Mastercard, etc.) to the merchant's bank. The fee is typically a fixed amount per transaction.

- PCI compliance fees are charged by the payment processor to help merchants maintain compliance with the Payment Card Industry Data Security Standard (PCI DSS).

- Chargeback fees are charged by the payment processor when a customer disputes a transaction and requests a chargeback.

The total cost of merchant account fees can add up quickly. Merchants should carefully consider the fees associated with each payment processor before choosing one.

In addition to the fees listed above, merchants may also be charged for other services, such as:

- Gateway fees are charged by the payment gateway for connecting the merchant's website and the payment processor.

- Fraud prevention fees are charged by the payment processor for providing fraud prevention services.

- Customer service fees are charged by the payment processor for providing customer service support.

Merchant Account vs. Payment Gateway

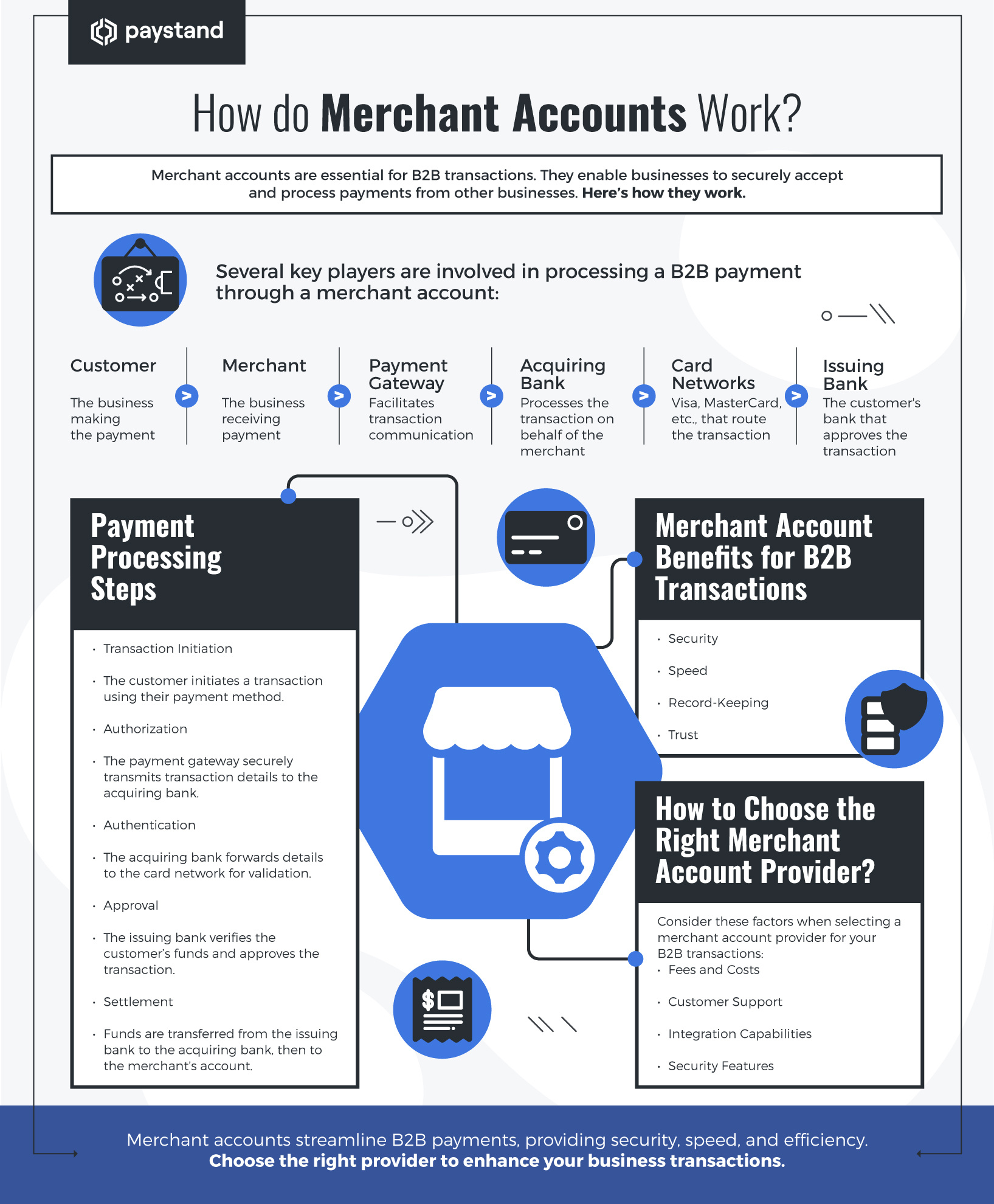

While both are crucial for processing B2B payments, they serve distinct functions and work together to facilitate secure and seamless transactions.

A payment gateway is a software application that securely transmits transaction data between your online store and the credit card networks. It encrypts sensitive information, such as credit card numbers, and sends it to the appropriate payment processor for authorization.

How Merchant Accounts and Payment Gateways Work Together

When a customer makes a purchase, the following steps occur:

- Checkout. The customer enters their credit card information during the checkout process.

- Encryption. The payment gateway encrypts the sensitive data and sends it securely to the payment processor.

- Authorization. The payment processor verifies the customer's credit card information with the card-issuing bank and authorizes the transaction.

- Settlement. The payment processor sends the authorized transaction amount to your merchant account.

- Funds Transfer. The funds are deposited into your merchant account within a few business days.

By carefully selecting and setting up a merchant account and payment gateway, you can create a secure and seamless payment experience for your customers, increase sales, and grow your online business successfully.

Drive Revenue with Paystand

Paystand is a flat fee-based payment solution that goes above and beyond your regular merchant account in terms of usability and features.

Our accounts receivable platforms integrate with all major ERPs and provide clients with the following:

- A seamless customer-centric payment portal

- Access to our bank network for transfers

- Ability to set convenience or “zero-fee” payment options

- Collection automation sequences

- Advanced analytics

- Notarized receipts

- eCheck, ACH, and innovative lockbox options

- Tokenization for information security

As a result, our users have seen a 60% decrease in DSO and saved up to 50% on the cost of receiving payments.

To learn more about how easy Paystand is to use and how it can benefit your business, talk to one of our experts today.