Knocking Down Barriers for a More Open and Equitable Financial Future

Here at Paystand, we believe that financial institutions have locked their customers into restrictive, expensive processes to collect and track revenue for far too long. These inefficient legacy operations result in time-consuming, costly, manual processes that cut into your bottom line.

Accounting departments spend around 36 hours manually reconciling payments every month. If there are manual entry errors, discrepancies, or other issues, that time increases drastically.

In today’s fast-moving digital world, there’s no reason to spend eighteen days out of your year reconciling payments and transaction fees. Software and alternative payment methods are available to mitigate that burden.

No more fees, please!

Transaction fees are rising, and the cost of reconciliation and managing labor for transactions is also increasing. When a transaction is complete, accountants must decipher a report that’s a mess of complicated fees. In addition, many clerks’ full-time job is to reconcile payments. The costs required to pay that employee are also associated with that transaction cost.

With inflation’s onset, business costs are rising in every sector. As a result, businesses need a solution to optimize their revenue by building a no-fee payment strategy that helps retain customers and decreases manual labor.

What we believe in

The future of finance is open, equitable, and accessible. We couldn’t be more thrilled to be a part of the financial revolution to democratize money movement and eliminate gatekeepers once and for all.

Three ways Paystand is knocking down barriers

BLOCKCHAIN-BASED | ZERO-FEES | AR AUTOMATION

Blockchain-Based

Paystand runs on the first Ethereum-based hybrid blockchain designed for B2B, ensuring your payment history is secure, digitally auditable, and free of tampering.

Blockchain is changing the financial industry for the better by establishing a decentralized ledger for payments, offering faster transactions and lower fees than banks on an international scale — with no global governing body, an immutable ledger, and fully transparent and searchable transactions.

One of the critical things the blockchain does is remove the need for intermediaries to verify transactions — that’s all code now. And that code is the same for everyone, period. So if you have access to the internet, you can transact on the blockchain without anyone’s permission.

Zero-Fees

There’s no reason businesses should lose a percentage of their every sale to transaction and convenience fees, so we built a payment infrastructure that eliminates them: Payments-as-a-Service (PaaS).

PaaS upends the traditional fee-based payment model, utilizing a subscription-based software model instead. With a low-cost subscription model, companies know their costs upfront, and when transaction volume climbs, the low monthly cost remains the same, and AR costs decline. As sales increase, companies can reap the rewards of higher revenues — rather than recalculate the costs of their higher fees.

The Paystand Bank Network provides digital payment options such as real-time fund-verified transfers, e-checks, and credit cards, all for a low monthly fee.

AR Automation

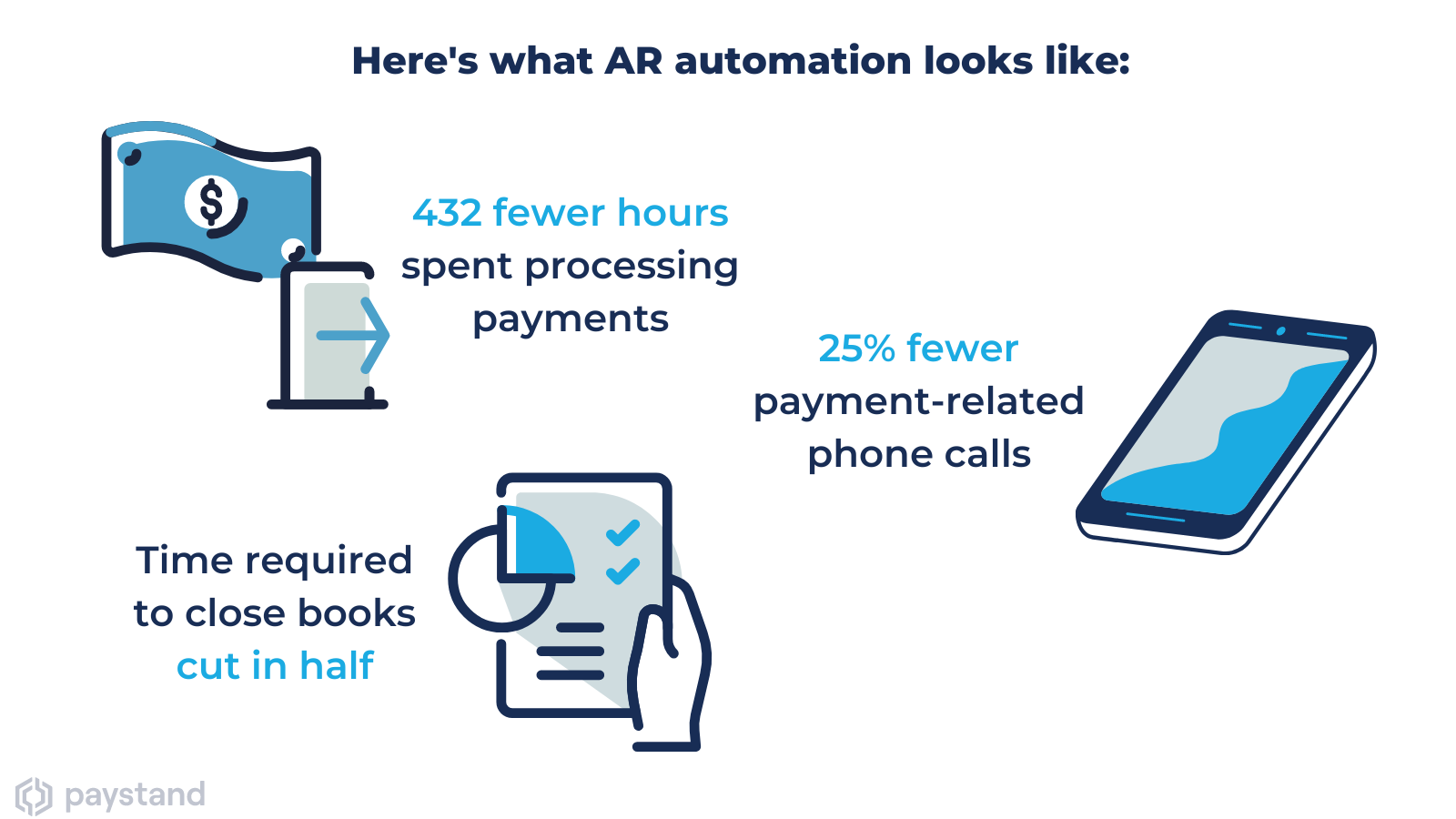

Think of all those time-consuming, repetitive, manual tasks you must perform monthly. That’s time that could be better used for more high-level, insightful, and impactful tasks.

.png?width=1600&height=900&name=Hours%20spent%20on%20reconciliation%20(1).png)

That’s where Paystand comes in. We do the work for you.

Say goodbye to manual cash application and reconciliation. Instead, Paystand automatically performs the cash application for each payment, uploading deposit reports when funds are sent to the bank.

Paystand streamlines the entire payment process, from invoice creation to reconciliation, cutting closing time in half and freeing your team for more high-level, strategic tasks (or for some much-deserved R&R).

Let us focus on the things that can be automated, so you can focus on the things that can't

Check out our blog to learn more about Paystand’s mission and how we’re revolutionizing the B2B finance industry. Then, to add more tricks to your toolbelt, download your free copy of our guide to eliminating credit card fees.