NetSuite Training for Accounting Professionals: What You Need to Know

With 95% of businesses improving their operations with ERPs, more and more organizations are investing in software. NetSuite takes over 10% of the global market.

But like many comprehensive, best-in-class ERPs, NetSuite is huge. Even excluding the hundreds of NetSuite Marketplace integrations, the core system is highly customizable. It includes models for every department, from manufacturing to HR and financial management, offering accounting and finance functionality.

We'll stick to the finance part as a solution geared towards accounts receivable (AR) professionals.

If you've already dabbled in or used the NetSuite platform, you know what we're talking about. Accounting professionals can do just about anything, including:

- Send and schedule invoices

- Reconcile payments

- Manage multi-currency transactions

- Budget and forecast revenue

Given the platform's capabilities, many professionals, including ERP consultants, seek NetSuite training or a NetSuite certification. Some higher-paying jobs might even require it.

We know the top questions:

- Where do you get NetSuite training?

- How much does it cost?

- How long does it take to learn?

How Do You Get NetSuite Training?

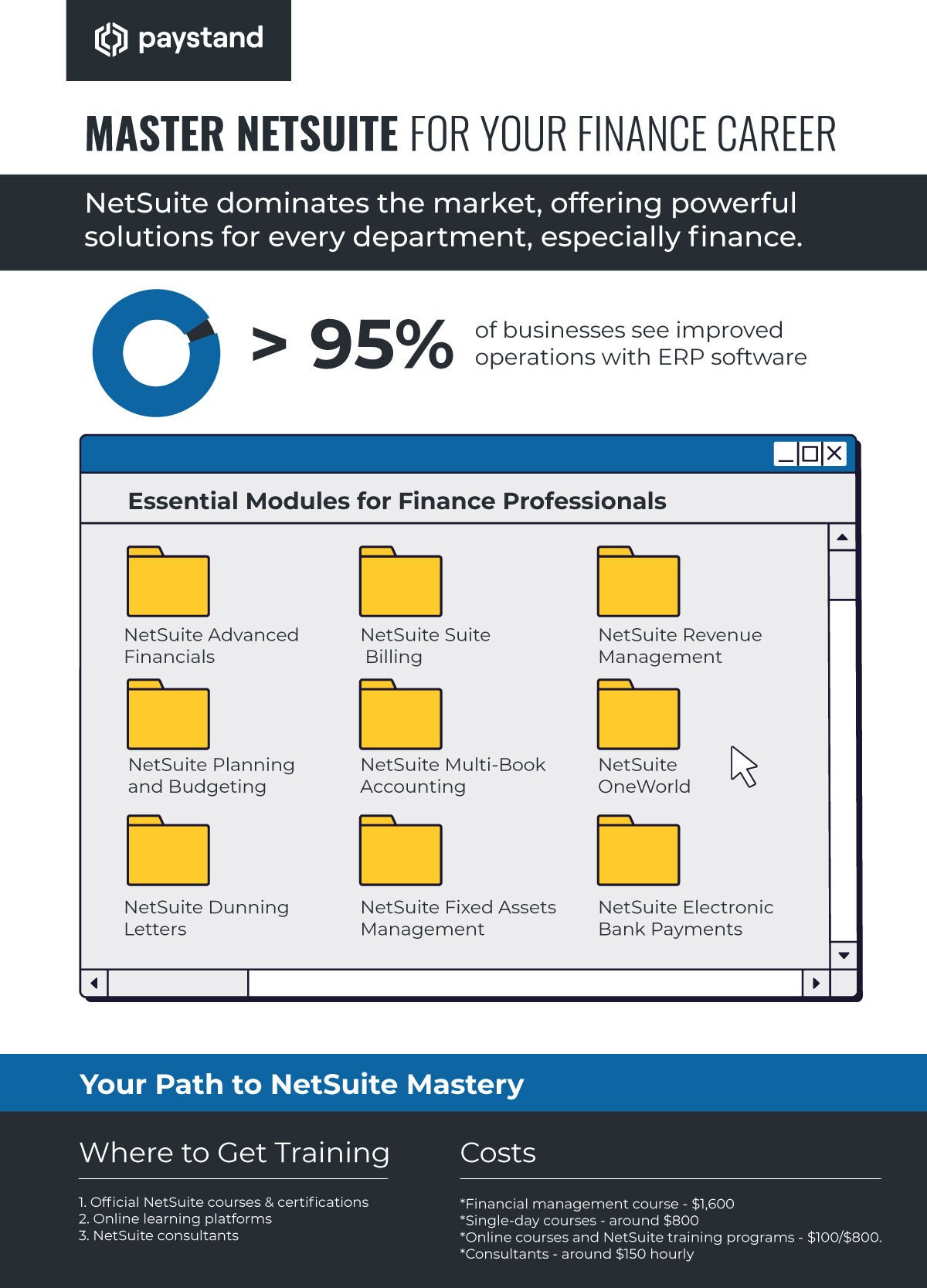

There are several NetSuite modules to ensure that every user has the tools to run their business. For financial management, there are:

- NetSuite Advanced Financials is for budgeting, expense allocations, amortization, and statistical accounts.

- NetSuite Suite Billing provides a portal for invoice and billing management while accounting for revenue accurately and compliantly.

- NetSuite Revenue Management automates revenue forecasting, allocation, recognition, reclassification, and auditing.

- NetSuite Planning and Budgeting offers company-wide and departmental budgeting and planning functions.

- NetSuite Multi-Book Accounting allows finance departments to create business transaction records across multiple books compliantly.

- NetSuite OneWorld supports multinational and multi-subsidiary operations.

- NetSuite Dunning Letters sets up an automated collection process.

- NetSuite Fixed Assets Management helps you track company-owned and leased assets. It also calculates depreciation and amortization schedules.

- NetSuite Electronic Bank Payments allows users to exchange electronic funds transfer payments.

There are also different modules:

- NetSuite CRM

- Human Resources

- Inventory

- Supply Chain,

- Professional Services modules exist.

What specific modules you will need and use depends on your business needs.

NetSuite Training for Accounting

To master the NetSuite ERP for accounting, accounts payable (AP), or accounts receivable (AR) processes, you can take the Financial User Certification Exam and fill all your NetSuite accounting gaps. The prerequisite is a two-day course on financial management that costs $1,600.

This specific course covers how to handle:

- Accounts payable workflows, including vendor management and issuing credit

- Accounts receivable processes, such as receiving payments and invoicing

- Banking and payment processing

- Billing schedules and transactions

- Budgeting

- Expense allocation

- Financial reporting and tracking KPIs

- How to use journal entries and the general ledger

- Period and yeard-end close workflows

- Subsidiaries, classifications, and chart of accounts

- Using smart dashboards

Before enrolling in this course, you should know basic accounting terms and have some NetSuite skills, as the exam requires using NetSuite for at least three months.

The Financial User Certification exam is a 60-minute test with 30 questions and costs $150.

You can also receive ongoing training through the NetSuite Online Learning Center resources, which offer dozens of courses and learning paths to help you navigate the platform's nuances.

How Much Does NetSuite Training Cost?

The financial management course, as mentioned, costs $1,600. Single-day courses average around often $800.

Online courses and NetSuite training programs can cost between $100 and $800. NetSuite consulting can also add up. Consultants charge around $150 hourly, especially if the courses or one-on-one sessions are weeks long.

Is NetSuite Hard to Learn?

Understanding what NetSuite solution you are using can help you estimate the time it will take to learn NetSuite.

If you've used an ERP or CRM before, you'll get a quick hang of the NetSuite basics after a few days. But diving deep into the platform helps you participate in a NetSuite training program, especially for your module. Oracle Netsuite is robust and has nine modules just for financial management, with many subsections and capabilities.

General users are advised to practice with the NetSuite platform for three months before their User Certification Exam. However, mastering administrator and developer roles may take over a year. You will likely need to invest in NetSuite training sessions with experts to understand the platform's capabilities thoroughly. You can also explore the NetSuite Marketplace and find integrations that adjust to your training needs and goals.

Streamline Your NetSuite Processes with Paystand

As a SuiteApp integration, we know NetSuite well. That's why our application automates and enhances the AR side of NetSuite. We help businesses:

- Decrease DSO by 60% or more

- Reduce fraud and chargebacks with real-time fund verification

- Improve customer experience with easy self-service B2B payment methods

- Boost revenue through payment strategy options, like zero-fee and convenience fee options

Our platform starts by mapping out and optimizing your specific NetSuite payments process. To learn more about improving your NetSuite experience, check out our B2B payments best practices guide.