What is a Credit Card Hold? A Closer Look

Table of Contents

- What is a Hold on a Credit Card?

- How Long Do Credit Card Holds Last?

- How Do I Put a Hold on My Credit Cards?

- Why Do Merchants Use Credit Card Authorization Holds?

- Why Would a Customer Be Put on Credit Hold?

- Types of Credit Card Holds

- The Main Problem of Credit Card Holds

- Alternative to Credit Card Holds

- Expand Your Payment Strategy with Paystand

Key Takeaways

- Credit card holds protect businesses and customers by withholding funds to verify accounts and prevent fraud, but can also lead to transaction rejections and penalties.

- A credit card hold is a temporary authorization placed on available credit by the issuer, preventing its use until the transaction is completed or canceled.

- Holds can occur due to suspected fraudulent activity, account reviews, or delinquent payments and can last from one day to 31 days, depending on the situation.

- Common reasons for credit holds include late payments, exceeding credit limits, returned checks, suspicious activity, credit score issues, bankruptcy, and violations of credit agreements.

Today, credit cards have become the preferred payment method for most Americans, thanks to their convenience and tracking capabilities. However, certain features of credit cards can have unintended adverse effects. One example of these effects is credit card holds.

With 90% of Americans owning at least one credit card, there's no doubt why credit cards are AR departments’ preferred payment method. Their rapid processing time and enhanced tracking capabilities make them easier to process. However, some credit card features can cause more harm than good. An excellent example of this is credit card holds.

Credit card holds are a helpful tool to protect businesses and customers alike. Organizations can provide refunds by withholding funds, verifying accounts to prevent fraud, and guarding against chargebacks. This ensures each transaction is secure before release. However, holds can lead to transaction rejections by the issuer and potential penalties.

Let’s examine this subject to understand credit card holds, their consequences, and our business alternatives.

What is a Hold on a Credit Card?

A hold on a credit card is a temporary authorization placed on a specific amount of available credit by the credit card issuer. It is typically used when a purchase is made, and the funds are not yet settled with the merchant. The hold prevents the cardholder from using the authorized amount for other purchases until the transaction is completed or canceled.

Holds can also be placed on a credit card for other reasons, such as:

- Suspected fraudulent activity. If the credit card issuer suspects a transaction may be fraudulent, they may hold the account until they can investigate further.

- Account review. If the credit card issuer is reviewing an account for any reason, they may place a hold on the account until the review is complete.

- Delinquent payments. If a cardholder is behind on their credit card payments, the issuer may place a hold on the account until the payments are brought up to date.

How Long Do Credit Card Holds Last?

The hold length can range from one day to 31 calendar days, depending on the industry and transaction type. Vendors can release the hold anytime and should not hold cards longer than necessary. Knowing the maximum hold length is crucial to avoid misuse charges and inform customers.

How Do I Put a Hold on My Credit Cards?

- During a CNP transaction, select "Authorization Only" for the total transaction amount to use the authorization hold.

- Consider making "Authorization Only" your standardized transaction type, depending on your business.

- If you need help understanding "What is a credit card hold?" and how to manage them, contact your card issuer for guidance.

Why do Merchants Use Credit Card Authorization Holds?

Many businesses use pre-authorization holds to ensure customers have funds on their cards. Merchants use holds to prevent chargebacks and potential fraud. Since holds are used when the final bill amount is unknown, they protect businesses against potential losses by verifying they have enough funds.

Due to the growth of customer chargebacks and fraud in recent years, this is a preventive measure. Merchants lose $3.75 for every $1 in chargebacks, and 40% of customers who use them to resolve disputes will likely do it again in 60 days.

Why Would a Customer Be Put on Credit Hold?

There are several reasons why a customer might be put on credit hold. Some of the most common reasons include:

- Late Payments. Businesses may put customers on credit hold if they have a history of late or missed payments to protect themselves from financial risks. Consistent late payments suggest unreliability and higher default risk.

- Exceeding Credit Limits. If a customer's account balance exceeds the approved credit limit, the business may put them on credit hold, preventing further debt and promoting account currency.

- Returned Checks. Customers' bounced checks may lead to account credit holds due to financial instability concerns, incurring fees and penalties for businesses.

- Suspicious Activity. To prevent fraud or financial loss, businesses may put a credit hold on accounts showing suspicious activity, such as unusual spending or large purchases with insufficient funds.

- Credit Score Issues. Businesses may put a credit hold on an account if the customer's credit score drops, indicating a higher risk of default.

- Bankruptcy or Insolvency. Businesses may place accounts on credit hold if customers file for bankruptcy or become insolvent due to the bankruptcy process involving debt reorganization, necessitating payment term adjustments.

- Violation of Credit Agreement. The business may hold a credit account for unauthorized purchases or cash advances to uphold the agreement terms and prevent financial losses.

Being placed on credit hold can have several negative consequences for the customer. It may affect their ability to make purchases, obtain additional credit, or negotiate favorable credit terms in the future. It's crucial for customers to understand the potential consequences of being put on credit hold and to address any outstanding issues promptly to avoid prolonged restrictions on their credit accounts.

Types of Credit Card Holds

- Authorization Hold. Confirms that the customer has the necessary money in their account balance to settle the transaction.

- Over-the-Credit Limit Administrative Hold. If your customer exceeds their credit card limit, an administrative hold will be placed on their card. This hold prevents customers from using their cards until they pay their outstanding balance.

- Late-Payment Administrative Hold. These holds are not issued by merchants but by the credit card issuer when customers fall behind on their payments. Such holds can last for months until the customer begins making regular repayments.

In all cases, administrative holds will prevent the customer from using their card to complete any further transactions online and offline. If you encounter a vendor with an administrative hold on their card, the only option is to request that they use a different debit or credit card.

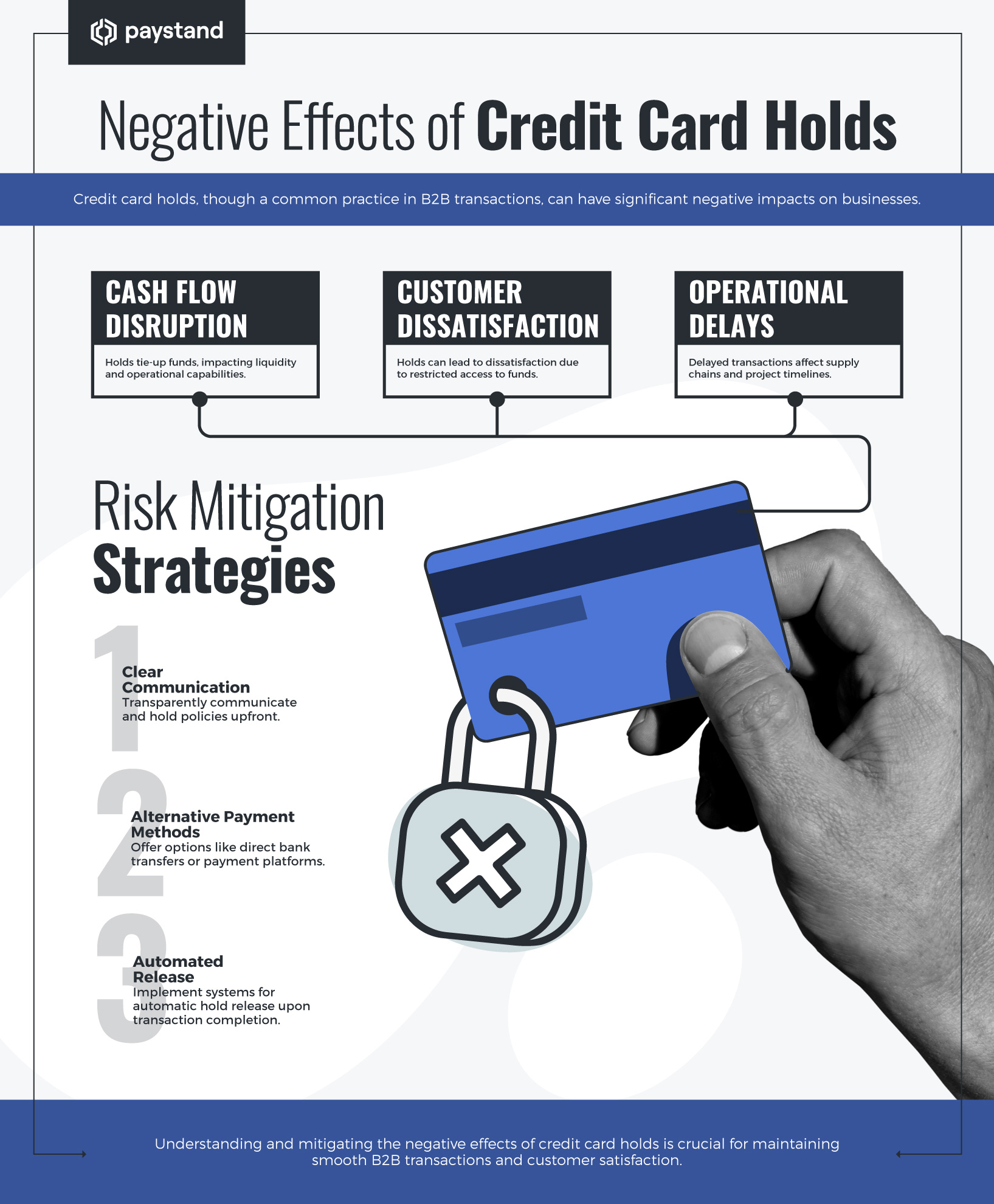

The Main Problems of Credit Card Holds

Authorization Misuse

The primary use of holds is to reserve the transaction amount until there is a final bill total or it aligns with the sales cycle. Holding a transaction for too long means you'll need to resubmit it. However, credit card issuers often charge you a hold "misuse" fee, and customers can issue a chargeback based on it.

What counts as authorization misuse?

- Holding an amount for too long

- Exceeding the hold amount

- Violating the card network's rules

- Refusing to settle transactions

Duplicated or Declined Transactions

Holds can make record tracking difficult, and approvals are not always guaranteed. This can lead to duplicate holds, which upsets customers and translates into fines and fees.

There's also a chance the issuing bank will decline the transaction. This makes it difficult for merchants and customers to determine what went wrong. For B2B customers, this messy situation can turn into late or no payments.

You may have more chargebacks, even if you use holds to avoid them.

Customer Convenience

Credit card payments are popular but holds disrupt the process. Authorization holds need careful monitoring, and companies must absorb the processing fees.

A temporary hold results in more work and fewer gains. This is why businesses seek alternatives to prevent chargebacks, fraud, and payment friction.

Alternatives to Credit Card Holds

Innovation, like bank-to-bank real-time exchanges, is becoming the norm. Low fees, instant account balance validation, trackable payments, and high-security measures appeal to merchants and customers.

Nowadays, payment gateways have security measures to protect payment and card information. Rather than holding transactions, we can digitally store information for future payments. Businesses can keep the customer's ACH data in their system and add extra charges.

For example, Paystand uses tokenization to streamline payments and protect sensitive data. Customers' sensitive information isn't stored but turned into a token for payment. They then authorize payments without adding their preferred method every time.

Some payment portals allow merchants to add a convenience fee to credit cards. This encourages customers to use ACH or bank-to-bank payments instead. Now, merchants can add a zero-fee option for their payment methods, leading customers to more secure transactions.

With digital payments such as ACH and bank-to-bank transfers, you don't have to worry about time limits, misuse fines, or other fees. You create a seamless experience, providing complete visibility and security for every transaction and mitigating other risks, such as fraud or chargebacks.

Expand Your Payments Strategy with Paystand

Managing B2B payments can be costly, increasing operating expenses and detrimental to your business's bottom line.

Paystand is committed to promoting fairness in the financial system and empowering businesses to succeed. As the leading payment solution for vendors, we provide zero-fee payment packages that can help you reduce the cost of receivables by up to 50%, directly improving your overall profitability.

Stay updated with the latest payment innovations and business insights. Subscribe to the Paystand newsletter today and never miss an update!