ACCOUNTS RECEIVABLES

- Receivables

-

Payables

ACCOUNTS payables

WHY NOW

Our push into Accounts Payables comes with our mission of becoming the one stop shop for the CFO.

By integrating AP, our financial suite becomes even more powerful as we aim to automate everything money.

-

Payments

OUR NETWORK

Discover how we enable your business to receive fee-less payments at a faster speed than your current solution.

We transition your costliest payers into cost-effective payment rails to return the most positive of ROIs.

- Expense

-

Resources

DATA & INFRASTRUCTURE

LEARNING RESOURCES

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Payments as a ServicePARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

ABOUT US

See how we are rebooting commercial finance.

Where We Operate

United states

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.canada

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

Accounting Automation Software That Saves Time and Prevents Errors

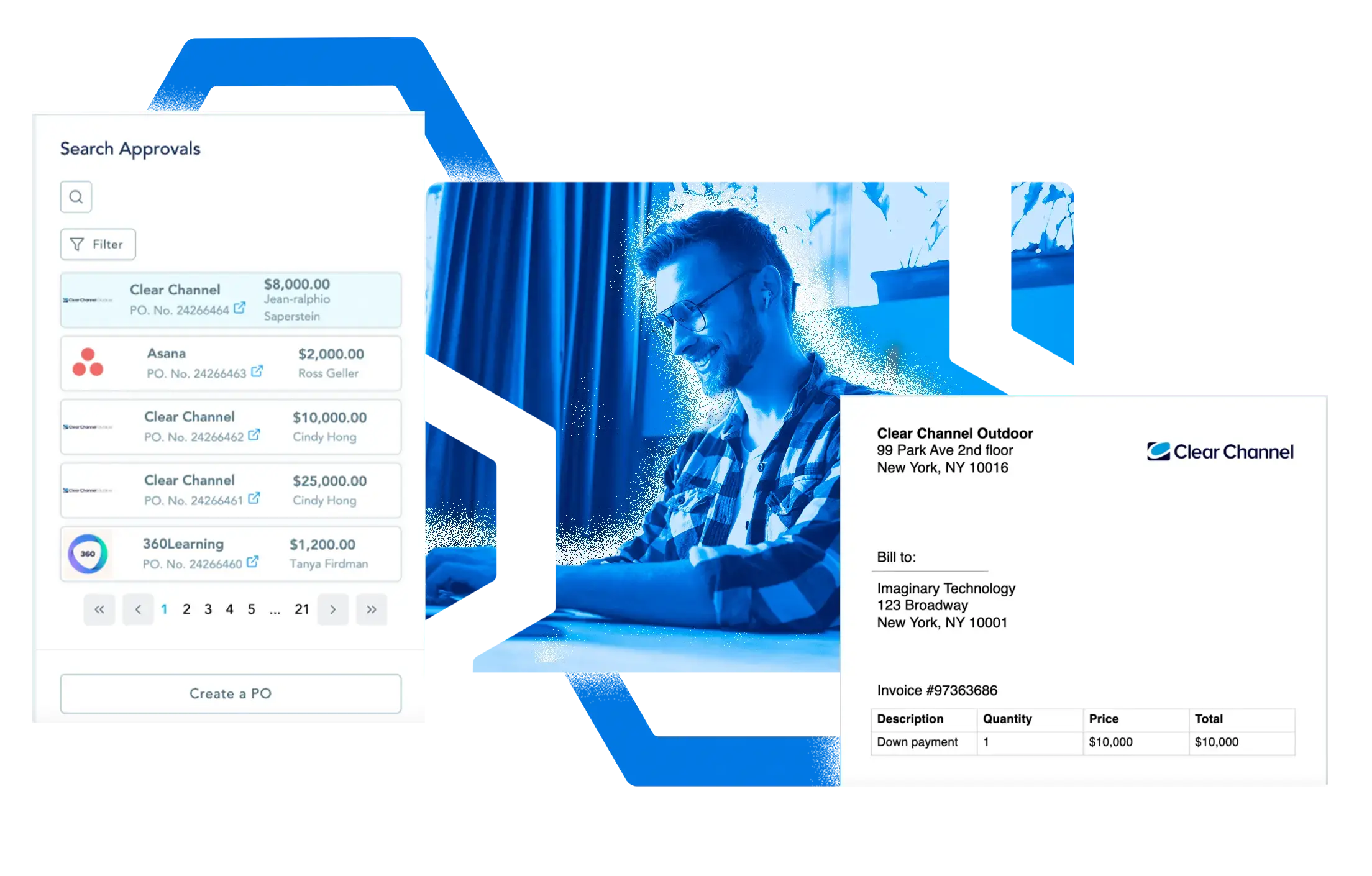

Enforce policy, reconcile transactions, and sync real-time reports automatically. Powered by Teampay and part of the Paystand accounting automation platform.

Why Paystand is the Best Accounting Automation Software for Finance Teams

Automate the Work You Shouldn’t Be Doing Manually

From purchase order matching to bill pay, Paystand simplifies the most time-consuming and repetitive accounting tasks. Optical character recognition (OCR) scans invoice data, creates bills, and matches invoices to existing POs automatically. Every purchase is tied to a complete audit trail so you never have to chase down approvals or search through email threads.

Policy Enforcement and Transaction Reconciliation Without the Spreadsheets

Every transaction complies with your rules by default. You can customize workflows to control spend by department, vendor, amount, and more. As purchases happen, they’re automatically reconciled with the right coding and receipts attached. No expense reports. No end-of-month surprises.

Testimonials

"We count on Teampay to approve, issue virtual cards, code, collect receipts, track spending and reconcile data in real-time! It has proper controls and promotes efficiency, saving my team countless hours and boosting productivity across the board. This is one of the best investments we’ve made!"

Linh Doan

Controller at Zumper

Know Where You Stand Anytime

With automatic reconciliation and two-way syncing, your transaction data updates instantly across systems. Close your books faster with real-time insights, clean coding, and reliable audit trails. Your accounting team stays in control without chasing down missing details.

Ready for Growth, Designed for Complexity

Whether you're managing multiple regions, business units, or currencies, Paystand adapts to your structure. With multi-entity support, project-level reporting, seamless integration, and scalable workflows, you can handle increasing complexity with ease.

Discover More Paystand Finance Automation Solutions

Accounts Payable (AP) Automation Software

Streamline invoice approvals and payments with real-time syncing.

Spend Management Software

Enforce policy upfront and manage company-wide spend from a single platform.

Corporate Cards

Issue secure virtual or physical cards with spend controls built in.

Procurement Software

Simplify purchasing with supplier management, PO tracking, and automated workflows.

Purchase Order Approval Software

Automate PO approval processes for faster procurement.

Global Payments

Manage cross-border payouts with foreign currency support and built-in compliance.

Frequently Asked Questions

1. What is accounting automation software?

Accounting automation software uses technology to handle repetitive accounting tasks such as transaction reconciliation, data entry, and invoice processing. This reduces errors, saves time, and improves accuracy.

2. How can accounting automation software benefit my business?

It reduces manual workload, speeds up month-end close, improves compliance, and provides real-time financial insights for better decision-making.

3. What ERPs does Paystand connect to?

Paystand integrates with leading ERPs such as Sage Intacct, Microsoft Dynamics 365, NetSuite, and more.

4. Can Paystand handle multi-entity accounting?

Yes, Paystand supports multi-entity, multi-currency, and complex organizational structures.

5. How quickly can I implement Paystand’s accounting automation software?

Implementation timelines vary depending on your ERP and workflows, but many customers go live within weeks.

Start Automating Your Accounting with Paystand’s Accounting Automation Software

Reduce errors, gain visibility, and close your books faster without disrupting your ERP.

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.