How to Find the Best AR Automation Software for Your Business

Finance professionals always search for ways to enhance efficiency and streamline financial operations. One powerful solution to address these challenges is finding the best AR automation software. But what exactly does this mean for CFOs and finance teams?

Imagine that tedious tasks of manual invoicing, chasing payments, and reconciling accounts are in the past. The best AR automation software offers a solution that automates and optimizes accounts receivable management. This lets finance professionals focus on strategic initiatives rather than mundane administrative tasks.

But with so many available options, choosing the best AR automation software can be daunting. Here's a comprehensive guide on what to look for to select the best one for your business.

What is AR Automation Software, and Why is it Important?

AR automation software streamlines and automates accounts receivable management tasks within a business. Instead of relying on manual methods like paper invoices and spreadsheets, it leverages technology to handle tasks such as sending invoices and payment reminders and reconciling payments.

Imagine you run a business that sells products or services to customers. Every time you make a sale, you invoice the customer, detailing what they owe you and when payment is due. Managing these invoices and tracking payments can be time-consuming and error-prone. You have to manually create and send invoices, keep track of who has paid and who hasn't, and follow up with customers who are late on payments.

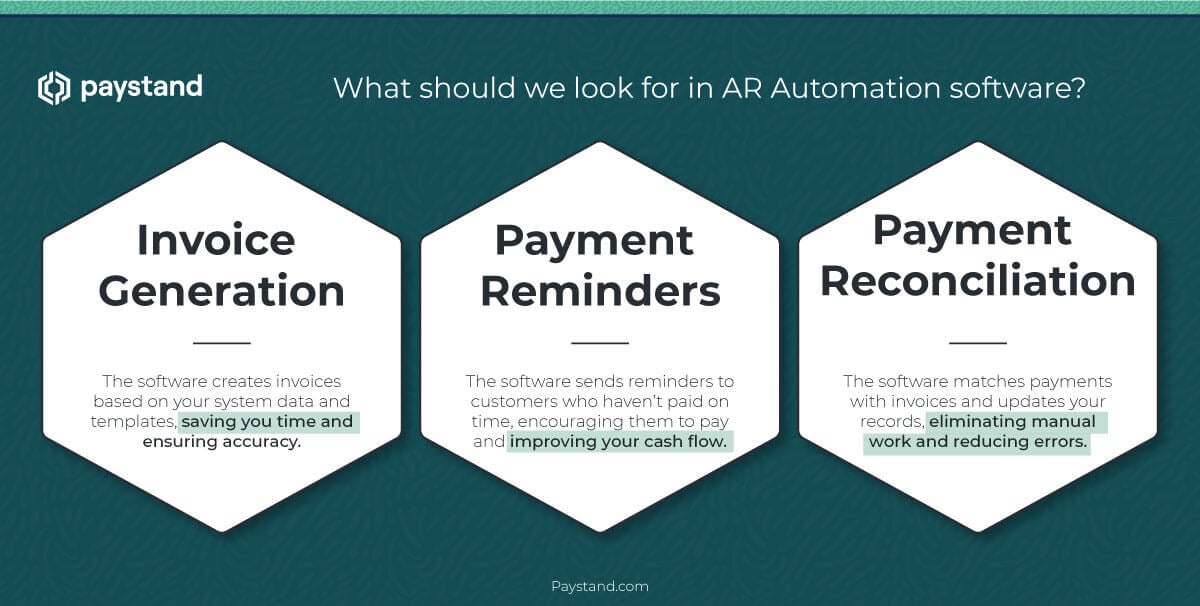

AR automation software simplifies this process by automating many of these tasks. Here's how it works:

- Invoice Generation. Instead of creating invoices manually, the software generates them based on templates and transaction data from your system. This saves time and ensures consistency in formatting and issuing invoices.

- Payment Reminders. If a customer hasn't paid by the due date, the software can send automated reminders via email or text, prompting them to submit their payment. This helps reduce late payments and improves cash flow for your business.

- Payment Reconciliation. When customers receive payments, the software can reconcile them against the corresponding invoices, updating your financial records in real time. This cuts the need for manual data entry and reduces the risk of errors or discrepancies.

Now, let's discuss why finding the best AR automation software is essential for businesses:

- Efficiency. By automating repetitive tasks, AR automation software frees time for your team. Now, they can focus on strategic activities, like analyzing data or developing strategies.

- Accuracy. Manual processes are prone to errors, leading to incorrect invoices or missed payments. AR automation software helps cut these errors by automating calculations and ensuring invoices are sent to the right recipients at the right time.

- Cash Flow Optimization. Prompt payment collection is essential for maintaining healthy cash flow in any business. AR automation software helps speed up the cash cycle by automating payment reminders and streamlining the payment process. This will improve your business's liquidity and financial stability.

- Customer Satisfaction. Sending automated invoices and payment reminders can enhance the customer experience. Customers appreciate businesses that make it easy for them to pay and keep track of their financial obligations.

- Scalability. As your business grows, so does the volume of invoices and payments you need to manage. AR automation software scales with your business. This allows you to handle workloads without adding significant overhead or resources.

AR automation software simplifies and accelerates the accounts receivable process. This improves efficiency, accuracy, cash flow, and customer satisfaction. Whether a small startup or a large enterprise, its implementation can benefit your business's success.

What are AR managers' main challenges when there's no automation?

- Time-Consuming Manual Tasks. AR managers spend considerable time on manual tasks like data entry, invoice generation, and payment processing. This manual effort is not only labor-intensive but also prone to errors, leading to delays in the billing cycle.

- Inefficient Invoice Processing. Manual invoicing involves printing, mailing, and tracking invoices. AR managers may struggle to keep track of overdue payments, resulting in delayed payments and cash flow issues.

- Difficulty in Tracking Payments. Without automation, tracking payments is challenging, especially for large volumes of invoices. This can lead to record discrepancies and difficulty reconciling payments with invoices.

- Lack of Visibility and Reporting. Manual processes often lack real-time visibility into outstanding invoices, payment statuses, and cash flow projections. AR managers may struggle to generate accurate reports and analyze trends.

- Increased Risk of Errors and Discrepancies. Manual data entry and processing increase the risk of errors and discrepancies in AR records. This can lead to billing inaccuracies, duplicate payments, and reconciliation issues.

- Limited Scalability. Manual processes may not scale efficiently to accommodate business growth. Handling a more significant workload can be challenging without investing in extra resources.

- Compliance and Security Concerns. Manual processes may lack robust security measures to protect sensitive financial information. AR managers may struggle to ensure compliance with regulatory requirements and safeguard against fraud or data breaches.

- Poor Customer Experience. Delays and errors in the billing and payment process can impact customer experience. Customers may become frustrated with late invoices, inaccurate billing statements, and inefficient payment methods.

Key Features to Consider

When choosing the best AR automation software for your business, several key features should be on your radar. Let's break them down.

Integration capabilities

Imagine your business is like a puzzle. Each piece represents a different system, like accounting, customer database, or inventory management. Integration capabilities mean your AR automation software can fit and connect with all the other pieces. This is crucial as it ensures that data can flow between systems, eliminating the need for manual data entry and reducing the risk of errors.

Customization options

Every business is unique, with its workflows, branding, and specific needs. Customization allows you to match your requirements, like adjusting invoice templates to reflect your brand or creating account receivable flowcharts that mirror your existing processes. This flexibility is essential for ensuring the software works seamlessly within your organization.

User-friendly interface

Imagine navigating a maze with confusing twists and turns versus strolling down a well-marked path. A user-friendly interface is like that well-marked path—it makes using the software a breeze, even for those who aren't tech-savvy. Look for AR automation software with an intuitive interface that's easy to navigate and understand. This will make adoption smoother for your team and reduce the need for extensive training, saving you time and resources in the long run.

These key features ensure that your AR automation software can seamlessly integrate with your existing systems, be tailored to your specific needs, and be easy for your team to use.

Compatibility with Existing Systems

When choosing the best AR automation software, one essential factor is how well it integrates with your current systems. You want everything to link without any gaps or conflicts. Here's a detailed look at what compatibility with existing systems means and why it matters.

ERP integration

Many businesses, such as finance, inventory, and human resources, rely on ERP systems to manage their operations. When AR automation software integrates with your ERP, they can communicate and share information.

For example, you generate an invoice using automation software. With integration, invoice data can flow into your ERP system without manual entry. This saves time and reduces the risk of errors when transferring data between systems.

Moreover, integration allows for real-time updates. If a payment status changes in your ERP, it can trigger actions in your automation software, such as sending payment reminders or updating account records. This ensures that everyone in your organization works with the most up-to-date information.

CRM integration

CRM systems are also critical, especially for businesses focused on sales and customer service. Integration with AR automation software enables a seamless data flow between departments.

For instance, a sales representative in your CRM system updates a customer's contact information. Integration automatically reflects that information in your AR software, ensuring that invoices and communications are sent to the right address.

Integrating CRM data with AR automation software provides valuable insights into customer behavior and payment patterns. You can identify trends, anticipate customer needs, and tailor your AR strategies.

Security Measures

In today's digital age, ensuring the security of your financial data is crucial. For AR automation software, you must ensure your platform prioritizes security to safeguard information from unauthorized access and cyber threats. Here's a look at the features you should consider.

Data encryption

Data encryption is like putting your information in a locked box before sending it online. It scrambles your data into a secret code only authorized users can understand. Look for software with robust encryption algorithms to protect your data when transmitted between parties. This ensures that even if someone intercepts your data, they won't be able to make sense of it without the encryption key.

Access controls

Access controls regulate who can view, edit, or delete sensitive information – including account receivable outsourcing providers. Choose software that offers granular access controls. This allows you to define specific permissions for different users based on their roles and responsibilities. For example, your finance team should have full access to billing data while limiting customer service representatives to viewing only customer information relevant to their interactions.

By prioritizing data encryption and access controls, you can reduce the risk of data breaches and ensure the confidentiality and integrity of your financial data within your AR automation software.

Reputation and Reviews

Reputation and reviews are crucial in helping you make an informed decision. A provider's reputation reflects its reliability, trustworthiness, and value. A company with a solid reputation will provide high-quality products and excellent customer service. Choosing a reputable provider can reduce the risk of software glitches, poor support, or security breaches.

How to assess reputation

- Customer Testimonials. Read testimonials and reviews from other businesses who have used the software. Pay attention to their experiences, both positive and negative, to get a sense of what to expect.

- Industry Recognition. Look for awards, certifications, or industry recognition that the software provider has received. This indicates acknowledgment of its innovation and effectiveness within the industry.

- Online Presence. Explore the company's website, social media, and online forums to research its reputation among its peers and customers. A solid online presence with active engagement is often a positive sign.

- Importance of Reviews. Reviews provide valuable insights into the real-world performance of the software. They offer firsthand opinions from users who have experienced the features, usability, and support. Reviews let you better understand the software's strengths and weaknesses and how it aligns with your business needs.

Reputation and reviews are excellent quality and reliability indicators. By researching the provider's reputation and analyzing user reviews, you can make a well-informed decision that aligns with your business goals and expectations.

Start Automating with Paystand

If you're ready to streamline your AR processes and take your business to the next level, it's time to consider Paystand. With its innovative AR automation features, you can revolutionize invoicing, payments, and collections.

- Improved efficiency. Say goodbye to manual data entry and tedious reconciliation tasks. Paystand automates the entire invoicing process, from generation to delivery. This will save your team time and reduce errors.

- Cost savings. By automating repetitive tasks and reducing the need for paper-based processes, Paystand helps you cut costs and improve your bottom line. Say goodbye to printing, postage, and late payment fees.

- Accelerated cash flow. With faster invoicing and automated payment reminders, Paystand accelerates your cash flow and reduces DSO. Get paid faster and improve your working capital.

- Security. Protect your sensitive financial data with Paystand's advanced security measures, including data encryption and robust access controls. Rest easy knowing that your information is safe and secure.

- Integration. Seamlessly integrate Paystand with your existing ERP and CRM systems to ensure smooth data flow. End siloed data and disconnected processes.

Ready to experience the benefits of Paystand firsthand? Book a demo today and see how our AR automation software can transform your accounts receivable processes.