Closing NetSuite Accounting Gaps: Enhance Your Financial Management

Oracle NetSuite is widely used for accounting, but it has some gaps. Proper implementation is essential, and while it is powerful, it lacks certain features. Paystand seamlessly integrates with Oracle NetSuite to address accounting gaps, enhancing the experience for better operations and financial management. To successfully use NetSuite, consider investing in NetSuite training and even pursue NetSuite certification to bolster your NetSuite skills.

For many B2B organizations, NetSuite Credit Card Processing is the pinnacle of accounting and operations management software. It does everything, but knowing its advantages and limitations is critical for a successful and proper implementation, especially for NetSuite's ERP side – which is why using a solution like NetSuite integrated payments is so beneficial.

Using the NetSuite ERP will directly affect cash flow, regardless of the industry. So, having a flexible but custom setup is essential for financial operations. Features like automated cash application NetSuite and ERP payment capabilities can significantly streamline these processes, offering enhanced reporting functionality and a smoother audit process.

But before we discuss how to fill the NetSuite accounting gaps in the system, let's examine why NetSuite implementations fail.

What Causes NetSuite Implementations to Fail?

According to Deloitte, 70% of digital transformations fail. The reasons range from poor leadership to a skillset deficit. And shifting from paper-based accounting or a smaller ERP to NetSuite is no exception.

A NetSuite implementation can fail for four primary reasons, including:

- Poor use case research

- Failing to customize business processes

- Lack of employee training

- Not allocating resources and budget for a successful implementation.

Regardless of the NetSuite solution to implement, the professionals using the software must be on board. A successful transition will work from the bottom up when mapping processes and pinpointing areas for optimization with NetSuite. Companies sometimes turn to the NetSuite marketplace to find tools that fill functional gaps.

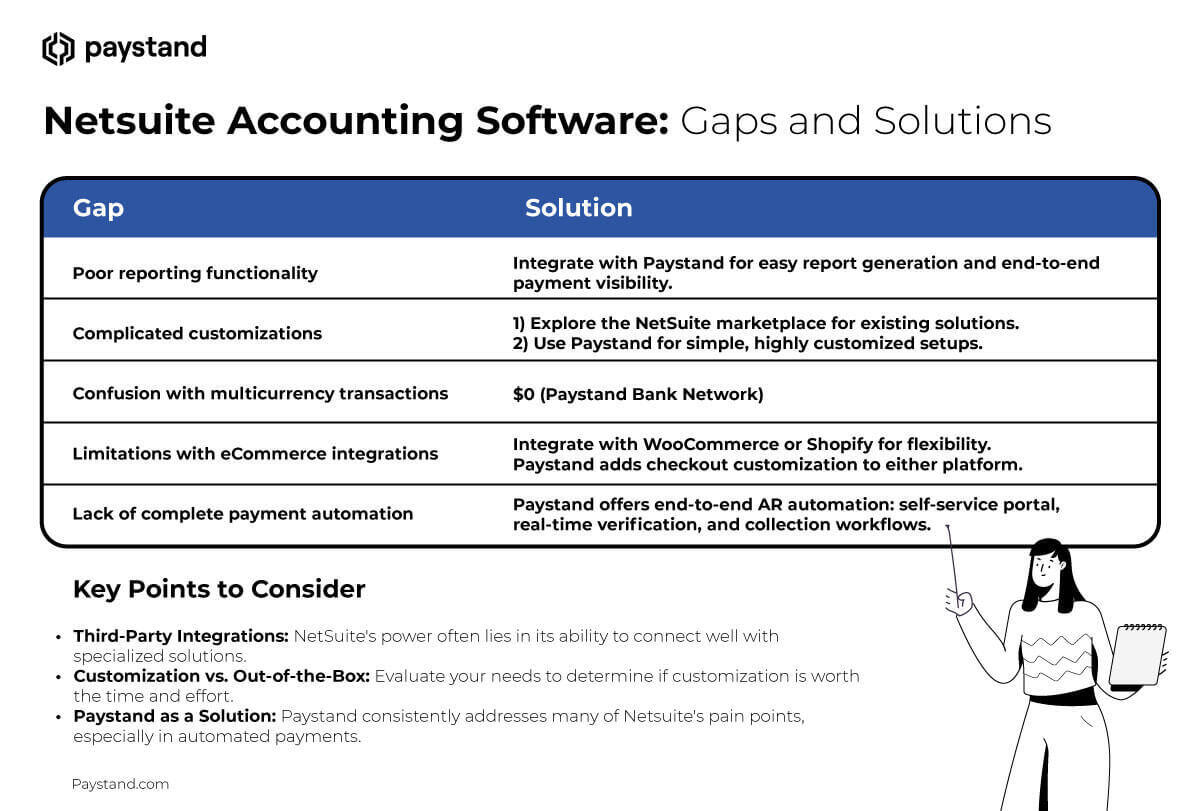

What Are the Gaps in Netsuite Accounting Software?

But there are some functions that NetSuite, as powerful as it is, doesn't do. Let's cover five missing or limited features you'll want to consider when building your implementation – along with their solutions.

Poor Reporting Functionality

One of the leading advantages of digitizing accounts receivable is efficiently generating reports. However, the NetSuite ERP reporting process can be cumbersome and needs more customization. Since ERPs are not automated and data is added manually, the risk of report discrepancies is high—either when data is added initially to the system or when compiling information. Accurate data management is essential for NetSuite account reconciliation processes and maintaining compliance with accounting standards.

Solution.💡 You likely have several third-party integrations with NetSuite. Paystand's provides end-to-end payment visibility and easy report generation, tailored specifically for finance and accounting needs. Access to your data should be effortless, and we ensure that NetSuite users can leverage their payment data without hassle or time delays.

Complicated Customizations

While NetSuite is a robust platform, customizations can be tricky. Adding extra features and expanding the scope for payments delays the launch of new functionalities. Mapping out the scope and using detailed cases is critical before software implementation. Consider exploring the NetSuite marketplace alongside customizations to see if any existing solutions can be easily integrated.

But the team can always benefit from improved customization, which can be achieved in two ways:

- Add the function in NetSuite

- Work with a third-party application

Solution.💡 Regarding payment management, the more customized the customer experience, the better. And with an automated Netsuite invoicing setup to match the books, it is even better.

Paystand's NetSuite integration provides a simple but highly customized payment setup. Automated data syncs with your general ledger, giving you more control over the AR process for a fraction of the effort.

More Currencies, More Confusion

Cross-border, multi-currency transactions are more complicated than they sound. All the money must be reported correctly, regardless of the currency. Users have reported that multi-currency transactions must be recorded in reports or the ledger. You can't turn multi-currency recordings off once you've added them to your system.

Solution.💡 Tools supporting multi-currency can ease the burden of correct reporting and reduce errors in revenue management. Paystand filters and organizes these transaction data first, so discrepancies in NetSuite are less likely to happen.

eCommerce Limitations

SuiteCommerce Advanced plugs eCommerce into the NetSuite ERP powerhouse. While it provides value for enterprise-level companies, the lack of options and custom solutions hits retailers hard. To compensate, explore the possibility of a NetSuite to QuickBooks migration to see if that offers the flexibility you need.

Solution.💡 NetSuite also integrates with WooCommerce and Shopify to remedy its limitations in order management. Paystand links to the NetSuite ERP or WooComerce, adding extensive customization to the checkout experience and providing better revenue recognition.

Lack of End-to-End Payments Automation

The NetSuite ERP can do much, but it's not entirely automated. For example, you can schedule invoices, but scheduling isn't the same as automation. Instead of manually setting dates and times, automation takes care of it for you.

Solution.💡 Paystand provides an end-to-end solution for AR professionals. It makes getting paid easier through a self-service customer portal, real-time verification, and automated collections workflows.

Streamline Your NetSuite Experience with Paystand

Paystand's easy-to-implement NetSuite solution provides all the tools to reduce late payments and boost cash flow. As the Venmo of B2B transactions, we provide a secure and swift payment automation platform with 100% visibility into your accounts receivables.

But don't just take it from us. See how effortlessly your accounting team can process payments in a custom demo.