How Medical Device Companies Can Improve Cash Flow with Digital Payments

Medical device companies, hospitals, and health systems are working hard to keep up with the demand COVID-19 has created. Revenue targets are being reassessed, work environments are changing, and finance teams are looking for ways to operate faster, leaner, and more efficiently to address both short and long-term sustainability.

Some companies may be seeing an explosive surge in demand and looking for ways to streamline operations and payment processes to expand capacity. In this situation, having a manual accounts receivable (AR) process can lead to delayed payments and unpredictable cash flow.

In either situation, businesses can benefit from an increased focus on expediting payment collection and managing cash flow more efficiently. This is where having a digital payment solution can help.

Benefits of digital payments for cash flow

Using a digital payment solution can solve challenges posed by both scenarios. When facing increased demand, these tools can help you operate more efficiently and decrease time to cash, freeing up valuable capital for further investment in operations and services.

If your business needs to conserve capital and gain more control over receivables, a digital payment solution can give you visibility over your collected and pending receivables so an invoice never goes unprocessed, unapproved, or unpaid. All of this removes friction from your payments process to help you get paid faster.

Here are 3 key benefits of using a digital payment solution:

Faster payments and collection process

Digital payment solutions make invoicing, payment processing, collection of payments, and reconciliation exponentially faster for both sides of the transaction.

- Invoices and payments can be automated to drive efficiency throughout the supply chain.

- Support more payment options to reduce late, delayed or missed payments.

- Paper checks may take weeks to arrive by mail; digital payment alternatives offer faster payment and settlement times.

- Add 'pay now' buttons to allow customers to make payments directly from the invoices, emails, statements, and sales orders you send.

- Payment information goes directly into your accounting system, eliminating data entry and reducing opportunities for errors, misunderstandings, or fraud.

Cost savings on payment collection

Traditional payments and paper invoices are inefficient to collect and expensive to process manually, taking an average of 6 days to process at a cost of $16 to $22 per invoice. In contrast, with a digital payment solution the cost to process an invoice is 50% lower and the average time to collect payment is 62% faster.

Take a look at the average ROI for Paystand customers:

- Reduce labor costs by $90,000

- 62% decrease in days sales outstanding

- Decrease transaction fees by ~$850,000

- Total savings on receivables: $1.2M over 3 years

Improved record keeping and cash flow management

Digital payment solutions also give you better visibility into the accounts receivable process and allows you to monitor your cash flow in real-time.

Paystand applies automation throughout the AR processes to help sort payment processing and reconciliation data, alert your team to potential late payments, and distinguish legitimate transactions from fraud attempts.

- Get a clear picture of your pending and outstanding receivables at a glance.

- Leverage real-time dashboard and reporting to monitor your key performance indicators and make critical revenue decisions on short notice.

- Focus on specific problem areas or delayed accounts with opportunities for improvement.

How Medical Device Companies Are Rethinking AR To Improve Cash Flow

In light of the current economic situation, businesses are looking for ways to cut down on inefficiencies and make the best use of their staff. Businesses with manual accounts receivable (AR) processes are struggling with limited visibility and control over their payments and receivables. And these problems create a bottleneck in payments and unpredictable cash flow.

This is why digital payment and AR processes will be a key focus for the rest of the year. Here are some of the key trends that will be important for the second half of 2020:

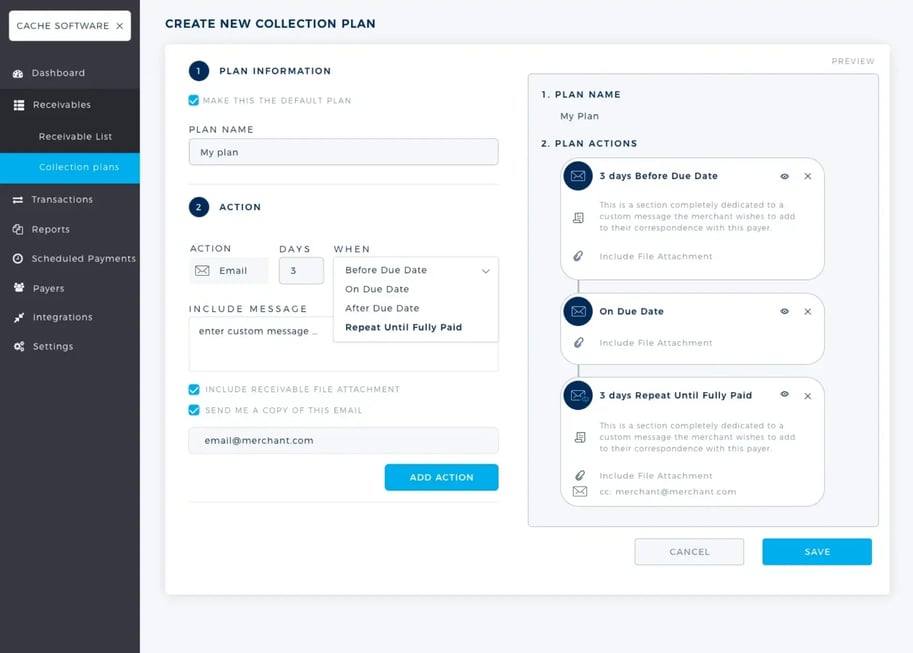

- Payment optimization. Companies will focus on shifting AR from a cost center to a profit center. This can include taking advantage of zero-fee payment rails, setting up collect plans to reduce late payments, offsetting transaction fees with least-cost-routing, and even monetizing payments with fee controls to maximize cash-on-hand while reducing fee exposure. Now is the time to re-assess processes and remove unnecessary steps to streamline operations.

Read: Controller's Guide to B2B Payment Optimization - AR automation. We will see increased use of robotic process automation technology to power AR. Businesses will use this to automate repetitive, time-consuming tasks like invoice presentment, payment collection, and reconciliation.

One untapped benefit of these tools is the ability to use payment analytics to make collections efforts intuitive. Some of the advanced benefits that automation can provide, includes: automatic creation of custom collection plans using payment history, delayed or missed payment prediction, and the ability to flag duplicate payments and other anomalies.

Read: How to Start Automating Your Accounts Receivable Process

- Remote AR management. Many organizations had been planning a move towards digital infrastructure, but current events accelerated this shift dramatically. We've seen a surge in companies looking for cloud accounting solutions to make their AR process location-agnostic. This allows AR teams to send invoices, collect payments, store payment information, and manage the entire payment process remotely. We will see more businesses shifting to remote accounting tools to avoid cash flow disruptions and allow employees to continue processing payments while working from home

Read: What is Zero-Touch payment processing (virtual payment collection and AR management) - Bonus, Spend Management: New digital tools like virtual cards (vCards) will become popular solutions for spend management. These cards will allow accounting teams to analyze spending and overhead in real-time. Companies will also use these vCards to control budgets, streamline expense management, identify unauthorized transactions, and prevent fraudulent activity.

Use Case: Major Medical Device Manufacturer

Paystand recently worked with a major national medical device manufacturer that makes ventilators and unified respiratory systems. Due to COVID-19, the company needed to digitize their payment operations and process orders faster and more efficiently to meet the increased demand for their products.

Paystand set up a digital payment portal for the medical device manufacturer and automated their payment collection process to quickly improve cash flow. The company now processes orders two weeks faster, which gives them the cash on hand it needs to scale production and get ventilators to hospitals and caregivers more quickly.

Get Started with Digital Payment Collection and Accounts Receivable Automation

Do you need to set up digital payments or streamline your accounts receivable process? Paystand makes it fast and easy to get started. Schedule a free demo with one of our payment experts or call us at 1-800-708-6413.