ACCOUNTS RECEIVABLES

- Receivables

-

Payables

ACCOUNTS payables

WHY NOW

Our push into Accounts Payables comes with our mission of becoming the one stop shop for the CFO.

By integrating AP, our financial suite becomes even more powerful as we aim to automate everything money.

-

Payments

OUR NETWORK

Discover how we enable your business to receive fee-less payments at a faster speed than your current solution.

We transition your costliest payers into cost-effective payment rails to return the most positive of ROIs.

- Expense

-

Resources

DATA & INFRASTRUCTURE

LEARNING RESOURCES

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Payments as a ServicePARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

ABOUT US

See how we are rebooting commercial finance.

Where We Operate

United states

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.canada

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

Wholesale Payment Processing, Without the Headaches

Trade credit, net terms, wire transfers—wholesale payments are complex. We simplify it all with zero-fee bank payments, ERP-native automation, and real-time AR insights.

Trusted by Wholesale and Distribution Leaders

Wholesale Payment Processing That Moves at the Speed of Business

Manual payment collection doesn’t cut it in today’s fast-moving wholesale environment. You need wholesale payment solutions that support trade credit, support ACH processing, and give your customers options—without slowing your team down.

With Paystand, you can automate the entire payment lifecycle, reduce costs, and unlock working capital from day one.

E-BOOK

Smarter Spend. Stronger Cash Flow

Discover how modern finance teams in wholesale and distribution are digitizing payments and streamlining AR to save time, reduce fees, and improve cash flow.

.webp?width=1458&height=1276&name=Ebook%20Mockup%20Smarter%20Spend%20(1).webp)

Why Wholesale Businesses Choose Paystand

Zero-Fee Bank Payments

Drive adoption of cost-effective ACH, EFT, and real-time payments with built-in payer incentives.

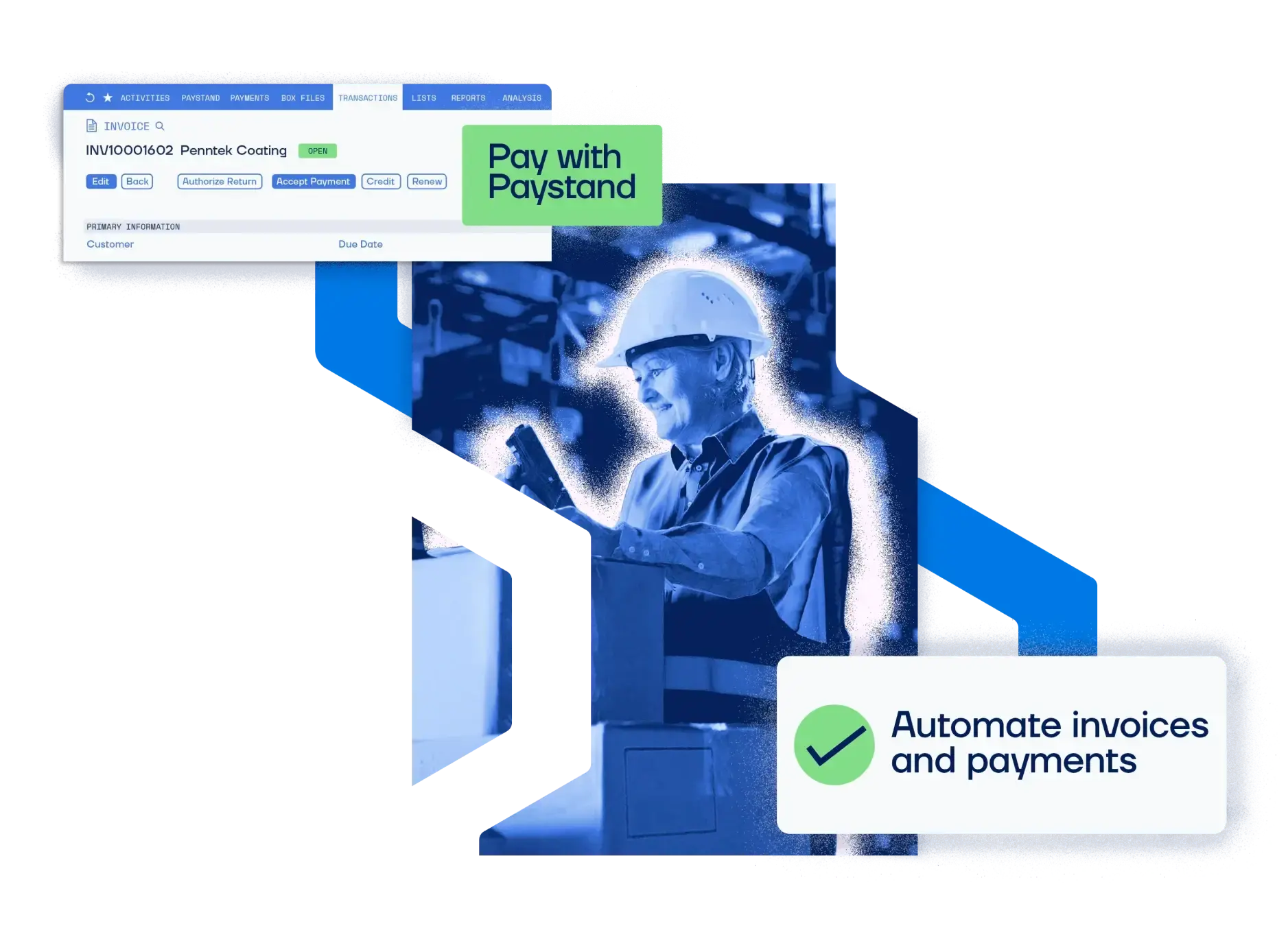

ERP-Embedded AR Automation

Native integrations with NetSuite, Sage, Microsoft Dynamics, and Acumatica mean no swivel-chair accounting.

Smart Controls for Trade Credit

Offer net terms with built-in automation and tracking—without the reconciliation nightmare.

Multi-Channel Payment Options

Accept and reconcile virtual cards, wires, and digital wallets without manual entry.

CASE STUDY

$65K Saved in 6 Months: How Penntek Doubled Payment Efficiency

Penntek Coatings faced inefficiencies with manual check processing, high credit card fees, and frequent month-end discrepancies, while struggling to modernize their payment experience and pass on processing fees.

With Paystand, Penntek automated payments, reduced credit card usage, streamlined month-end adjustments, and improved cash flow management, saving time and costs while enhancing the customer experience.

Frequently Asked Questions

1. How can wholesale businesses automate their payments?

With Paystand, wholesale companies can embed payment links into digital invoices, offer self-service portals for customers, and automate payment matching inside their ERP.

2. How can wholesale businesses reduce payment processing fees?

Our zero-fee bank network and built-in payment incentives shift customers away from credit cards and toward ACH, EFT, and real-time payments.

3. How does Paystand's blockchain technology enhance wholesale payment processing?

Paystand uses a blockchain-based ledger to create an immutable audit trail for every transaction, increasing transparency and reducing fraud risks in wholesale payment workflows.

4. What are the benefits of automating AR with Paystand?

Wholesale businesses can reduce DSO, eliminate manual work, improve cash flow forecasting, and free up staff to focus on higher-value activities.

5. How does Paystand keep wholesale payments secure?

Beyond blockchain, our platform includes advanced encryption, role-based access, and secure bank integrations for safe, scalable B2B payment processing.

6. Can I use Paystand with our accounting software?

Absolutely. Paystand integrates with the leading ERPs and solar energy billing software, so you can automate payments without disrupting your current financial workflows. Whether you're using NetSuite, Microsoft Dynamics, or a solar-specific platform, we plug in seamlessly.

Get a Demo of Wholesale Payment Processing That Pays Off

Stop paying high fees. Start getting paid faster. Fill out the form and see what zero-fee, automated AR looks like for your wholesale business.

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.